SafeTree Launches Landmark Report and AI Tool to Accelerate Growth of Surety Bonds in India

Sep 11, 2025

PRNewswire

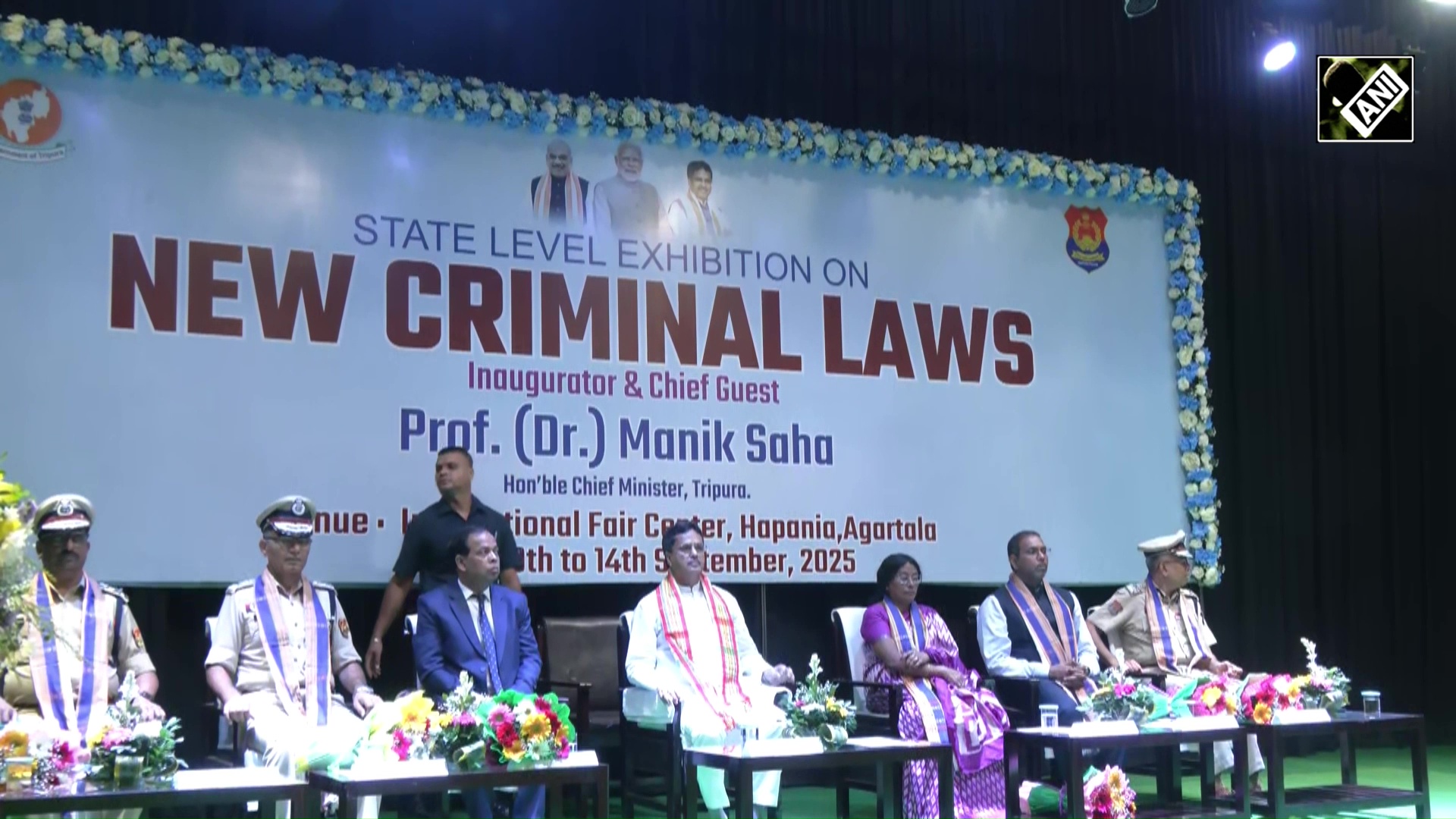

New Delhi [India], September 11: In a significant step toward enhancing India's infrastructure financing ecosystem, SafeTree Insurance today launched its flagship report, 'Insurance Surety Bonds in India: From Policy to Practice,' alongside a new AI-powered underwriting tool that aims to simplify and scale the adoption of surety bonds. The launch was part of a workshop on the Implementation of Insurance Surety Bonds and e-BGs organised by National Highways Authority of India (NHAI), held in New Delhi.

The report provides a comprehensive analysis of the insurance surety bond market in India--tracing its regulatory evolution, benchmarking international models such as those in the United States and Brazil, and proposing actionable solutions to address gaps in underwriting capacity, contractor credit data, and operational scalability in India.

Commenting on the launch, Shri Rajendra Kumar, Member (Finance), NHAI, emphasized the strategic role of surety bonds in India's infrastructure push: "Surety bonds represent a forward-looking mechanism to unlock liquidity for contractors while ensuring strong financial safeguards for project owners. We welcome this knowledge initiative from SafeTree, which will help accelerate adoption across the infrastructure ecosystem."

As India looks to scale its infrastructure ambitions under the Hon'ble Prime Minister's vision, innovative instruments such as surety bonds will play a critical role. Shri Nilesh Sathe, Former Member, IRDAI, noted that, "The insurance surety bond market in India is at an inflection point. With strong policy backing and technology-led innovation, it can become a transformative tool. SafeTree's report and AI platform are timely contributions to this journey."

The event also highlighted SafeTree's AI-based underwriting tool, designed to assist insurers in evaluating unrated MSME contractors using a composite of financial, sectoral, and project-specific data. This initiative aims to reduce the time taken by insurance companies to analyse contractors' data and bridge the information gap that often limits the issuance of bonds to only large, rated contractors.

Reflecting on NHAI's leadership in operationalizing surety bonds, Shri Ashish Kumar Singh, CGM (Finance), NHAI, mentioned, "NHAI has been at the forefront of this transition, having accepted over 1,400 insurance surety bonds to date. We are encouraged to see ecosystem partners like SafeTree building the right enablers to deepen market participation and reduce execution risk."

Mr. Vikas Anand, CEO, SafeTree, reiterated the company's long-term vision: "We are proud to be among the early movers in this space. Our AI underwriting tool and this report reflect our belief that surety bonds--when backed by intelligent data and collaborative policy--can truly reshape infrastructure execution in India."

This event marks an important step forward for ecosystem collaboration in the surety space. SafeTree has been working closely with insurers, underwriters, and public authorities to make insurance-backed surety guarantees more accessible, scalable, and digitally enabled.

About SafeTree:

SafeTree is a registered trademark of A2V Insurance Brokers Private Limited. (IRDAI License No.: 708 | Valid Till: 30.04.2026). To learn more about the Company and how it is planning to change insurance landscape, do visit us at http://www.safetree.in

Photo: https://mma.prnewswire.com/media/2771093/SAFETREE_Report_Launch.jpg

(ADVERTORIAL DISCLAIMER: The above press release has been provided by PRNewswire. ANI will not be responsible in any way for the content of the same)