SEBI explores pilot programme for regulated pre-IPO trading venue

Aug 21, 2025

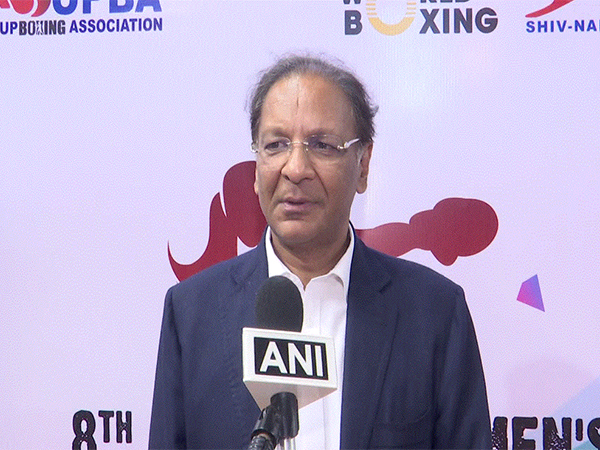

Mumbai [Maharashtra], August 21 : India's securities regulator is considering establishing a pilot programme for a regulated trading platform where companies can trade shares before their initial public offerings, Tuhin Kanta Pandey, Chairman of the Securities and Exchange Board of India, said at FICCI's CAPAM2025.

Speaking at the 22nd edition of the conference, the SEBI Chairman outlined the proposal as part of broader reforms aimed at deepening India's capital markets.

"Can we think of an initiative on a pilot basis for a regulated venue where pre-IPO companies can choose to trade, subject to certain disclosures?" Pandey asked industry delegates at the conference, which focused on driving growth through innovation, technology and transparency.

The proposal comes as India's capital markets have scaled rapidly, with 130 million unique investors and 70 million mutual fund investors participating in what has become the world's fourth-largest securities market. Primary market fundraising reached Rs. 4.3 trillion in the financial year 2025, with a robust pipeline of Rs. 1.4 trillion identified for future offerings. Cash market volumes have doubled over three years, but the regulator believes much more needs to be done to deepen the underlying equity market.

Anant Goenka, Senior Vice President of FICCI, noted that mutual fund assets under management have crossed Rs. 75 trillion, representing a sixfold increase over 10 years and reflecting the rapid financialisation of household savings.

Industry leaders at the conference backed calls for market expansion through new products and asset classes. Sunil Sanghai, Chairman of FICCI's Capital Markets Committee and founder of NovaaOne Capital, proposed three key areas for development: expanding exchange-traded funds and index products, which currently represent 10 per cent of the market compared with 20 per cent globally; developing the fixed income market to match equity market size at approximately Rs. 5 trillion; and adding new asset classes to REITs and InvITs, which have grown to USD 100 billion in assets under management over five to seven years.

"The next five to 10 years look extremely promising. There are extraordinary possibilities," Sanghai said, noting that India's capital markets are approaching the size of Japan's USD 6 trillion market and could add another market of equivalent size within the coming years.

Ashish Chauhan, Managing Director of the National Stock Exchange, highlighted the technological advances underpinning market growth. NSE now processes over 2000 crore transactions in six hours on peak days through 2.2 lakh terminals across India, with trading speeds reaching nanosecond response times that he claimed made NSE "the fastest stock exchange in the world by miles".

The exchange has grown from 200 permitted trading companies at inception to more than 2,800 listed companies today, with market capitalisation reaching Rs. 450 lakh crore (USD 5.2 trillion), a 125-fold increase over 30 years. Retail participation has surged, with investor numbers growing sevenfold to 11.8 crore over 11 years, covering 99.85 per cent of India's postal codes.

Nehal Vora, Managing Director of Central Depository Services Limited (CDSL), emphasised the democratisation of market access, noting that India now has over 20 crore demat accounts with 80 per cent originating from tier-II and tier-III cities. The youngest account holder is just 45 days old, reflecting the market's expanding demographic reach.

Technology initiatives are also advancing investor protection measures. SEBI will roll out a UPI validation system for registered intermediaries from 1 October 2025 to protect investors from cyber fraud. The regulator has issued guidelines emphasising a tiered approach to artificial intelligence adoption, with clear accountability measures and data controls.

The ideas outlined at the conference form part of SEBI's broader strategy to simplify and rationalise the regulatory framework whilst maintaining investor protection standards. Between March and June 2025, the regulator approved several ease-of-doing-business proposals for listed companies, alternative investment funds, and foreign portfolio investors.

"The task of capital formation in the face of global headwinds in the era of geopolitical and geoeconomic fragmentation is a daunting challenge," Pandey acknowledged. "We need to put our heads together to meet the challenge."

Industry participants expressed confidence that under SEBI's current leadership, India's capital markets would continue serving as a key engine for the country's aspirations to become a developed nation by 2047, with deeper and more liquid markets supporting the financing of infrastructure, green transitions, and digital transformation initiatives.

Vijay Chandok, Co-Chair, FICCI Capital Markets Committee and MD & CEO, National Securities Depository Limited, delivered the vote of thanks.