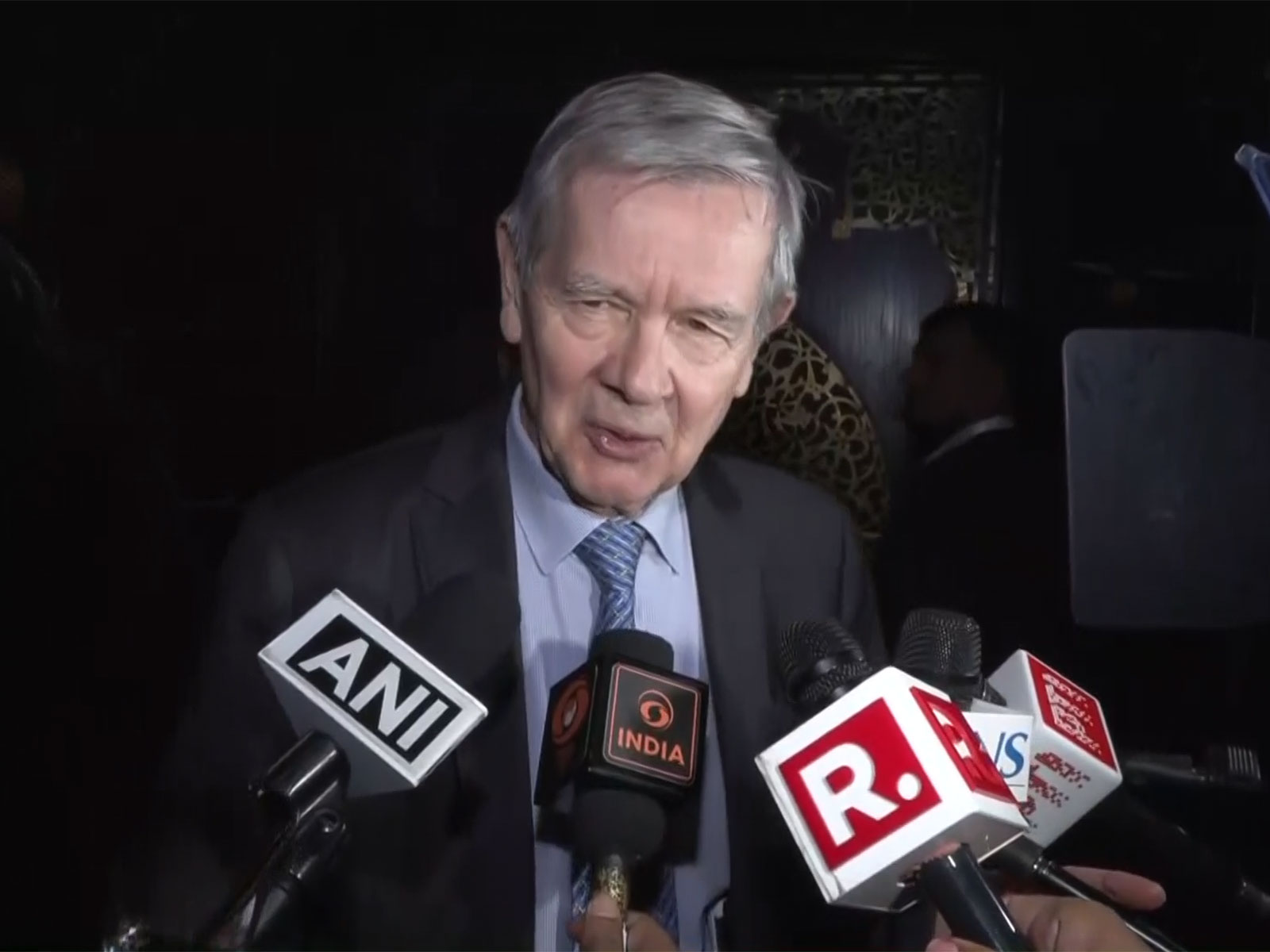

Senior citizens likely to get relief under targeted tax measures in Budget 2026: Deloitte ED Garg

Jan 18, 2026

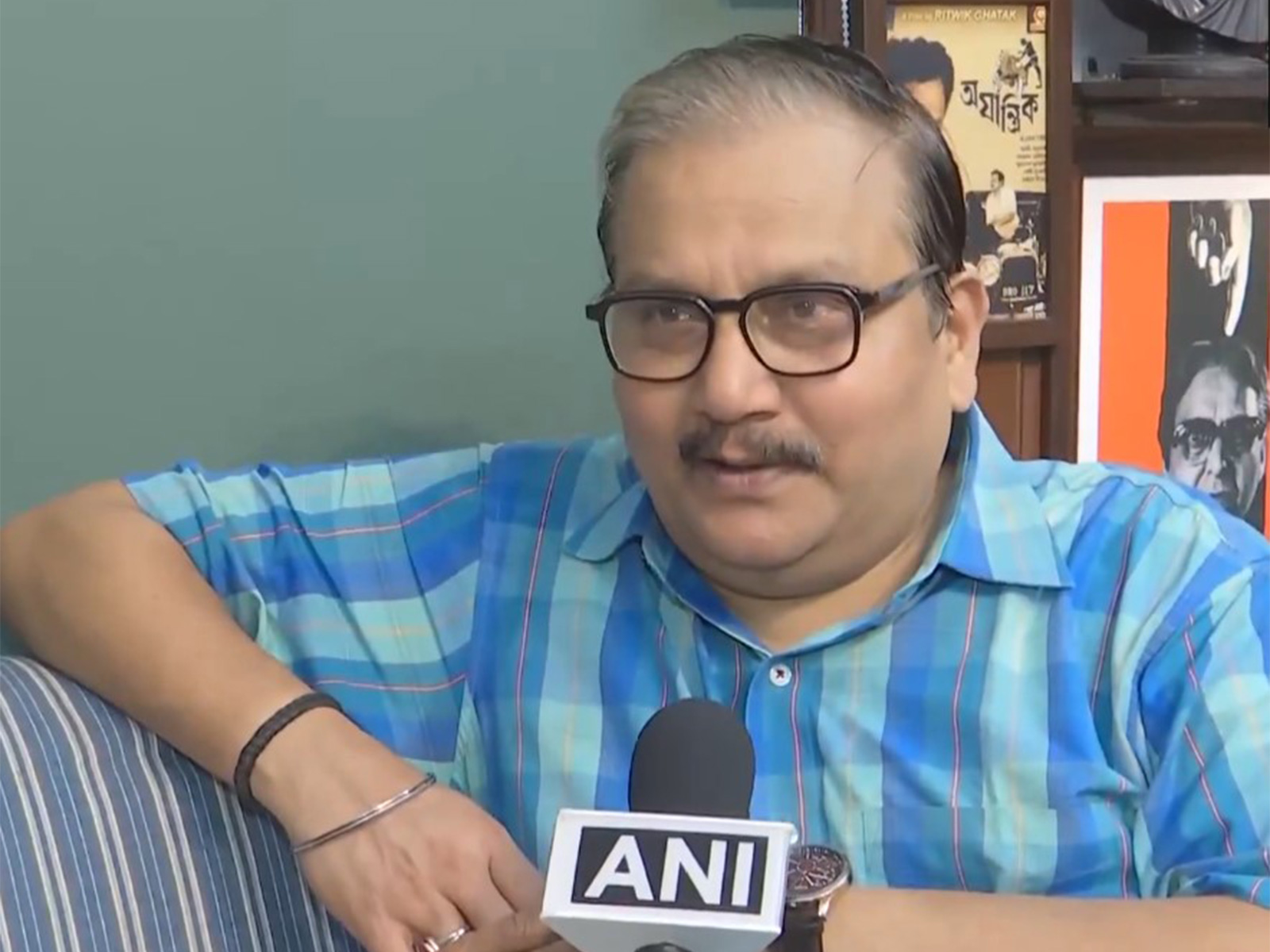

New Delhi [India], January 18 : Senior citizens could be among the biggest beneficiaries of India's Union Budget 2026, with the government expected to consider higher deductions on interest income and healthcare-related relief according to Tarun Garg, Executive Director at Deloitte India.

"I would call it from an individual tax perspective that the government may want to give some impetus to senior citizens," Garg told ANI in an exclusive interview. "Medical expenditures are increasing and they have to put in more on their health budget and healthcare, so maybe some bit of additional deductions may be given to senior citizens."

As has been the convention, the Union Budget for 2026-27 will be presented in the Parliament on February 1.

Garg said there is also growing demand to raise deductions on interest income earned from bank deposits and small savings schemes.

"There is a vast majority of individuals who are saying that this should be increased," he said, referring to the current limits of Rs 10,000 for non-senior citizens and Rs 50,000 for senior citizens. According to Garg, higher exemptions on interest income could help senior citizens cope with inflation and rising living costs.

Beyond senior citizens, Garg said Budget 2026 is more likely to focus on fine-tuning the new tax regime rather than announcing "path-breaking or huge changes", particularly because "the government also doesn't have that kind of a kitty within their availability".

One such targeted change could involve provident fund contributions. Garg said the government "may want to bring in" employer-driven provident fund deductions into the new tax regime.

"When we talk about provident fund, you are doing it structurally through the employer, and you do not need to furnish additional proofs for that," he said, adding that this could help bridge gaps between the old and new tax regimes without increasing compliance burdens.

He also flagged the standard deduction as an area where limited relief could be offered. "This is one area that can see some tweaks," Garg said, noting that while the old tax regime has seen little change in recent years, the standard deduction under the new tax regime "may get further increased", possibly by Rs 25,000 or more.

Such a move, he said, would provide relief to salaried taxpayers without reopening tax slab rates.

On rate rationalisation, Garg struck a cautious note. "From a rate changes perspective, I do not see there will be much," he said, adding that slab rates under the new tax regime are unlikely to be altered. However, he said there could be "certain tweaks" on the surcharge side, as the government looks to address inflationary pressures.

"There are demands that maybe one or two percent surcharge may be reduced, but whether that will see the light of the day is something one has to wait for February 1," he said.

Garg also pointed to improvements in compliance driven by digitisation. Referring to the Annual Information Statement (AIS) and Tax Information Statement (TIS), he said these tools "definitely contain a lot many details about the income taxpayer" and have made return filing easier. "At least 50-60% of the information is already available and pre-filled," he said, saving time for individuals.

However, Garg cautioned taxpayers to remain vigilant. "You need to check whether these details are correctly populated or not," he said, warning that errors or duplication could result in the same income being taxed twice if not corrected.

Overall, Garg said Budget 2026 is likely to prioritise targeted relief and administrative ease over broad personal tax reforms.