Sensex, Nifty open in green; sentiments are up on Israel-Iran ceasefire but remain fragile: Experts

Jun 25, 2025

Mumbai (Maharashtra) [India], June 25 : The Indian stock markets opened in the green on Wednesday, with the Nifty and Sensex both maintaining their previous strength, buoyed by easing tensions in the Middle East and positive sentiments in the global markets.

In the opening, the Sensex was up 328.73 points or 0.40 per cent at 82,383.84, and the Nifty was up 91.50 points or 0.37 per cent at 25,135.85.

"With the S&P 500 hovering near record highs, all key moving averages and momentum indicators are pointing towards continued bullish strength, said Sbi Securities in its market note.

"Going ahead, the zone of 24930-24900 will act as immediate support for the index. If the index slips below the level of 24900, the next crucial support is placed at the 24750 level," the note added.

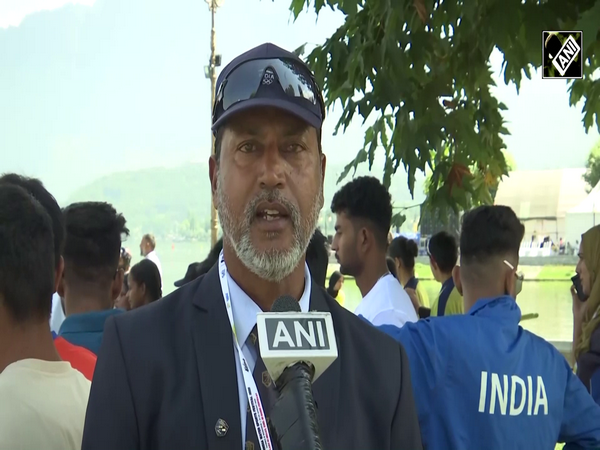

"The tentative Middle East ceasefire is holding up. Markets are ignoring tail risks and bidding up stocks from Asia to Europe to the US. Fed Chair Powell's testimony to the US Congress was as per expectations, but the markets saw dovishness in his logical assertion that if labour markets weakened unexpectedly while inflation did not rise, the FOMC cavalry would ride to the rescue," added Ajay Baga, Banking and market expert.

According to Bagga, the Trump Tax bill will be the other focus area for markets. "Overall markets are up on the Iran-Israel ceasefire but remain fragile," he added.

In the closing session on Tuesday, Indian stocks ended higher, with the BSE Sensex rising about 158 points and the Nifty 50 at the National Stock Exchange (NSE) closing above the 25,000 mark.

On Tuesday, all three major U.S. indices witnessed a sharp upside rally. Both the Nasdaq and S&P 500 are now just a stone's throw away from their all-time highs.

The rally followed President Donald Trump's announcement that a ceasefire between Israel and Iran is now in effect. Although both nations have accused each other of breaching the agreement, market participants remained optimistic about a potential de-escalation in Middle East tensions.

Experts said that tensions between Israel and Iran are de-escalating. investors are now shifting focus to upcoming global events that could influence markets.

One of the key dates on investors' radar is July 9, the deadline related to US tariff decisions. If tariff concerns are deferred or resolved, the markets may continue their upward trend.