Sitharaman takes dig at Congress; says IMF report does not question India's GDP figures, government is updating base year

Dec 03, 2025

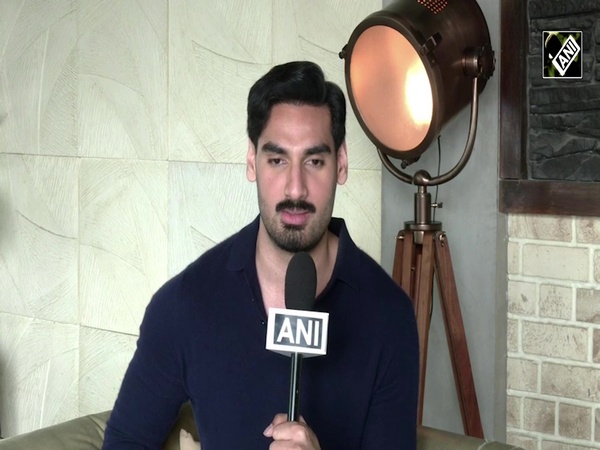

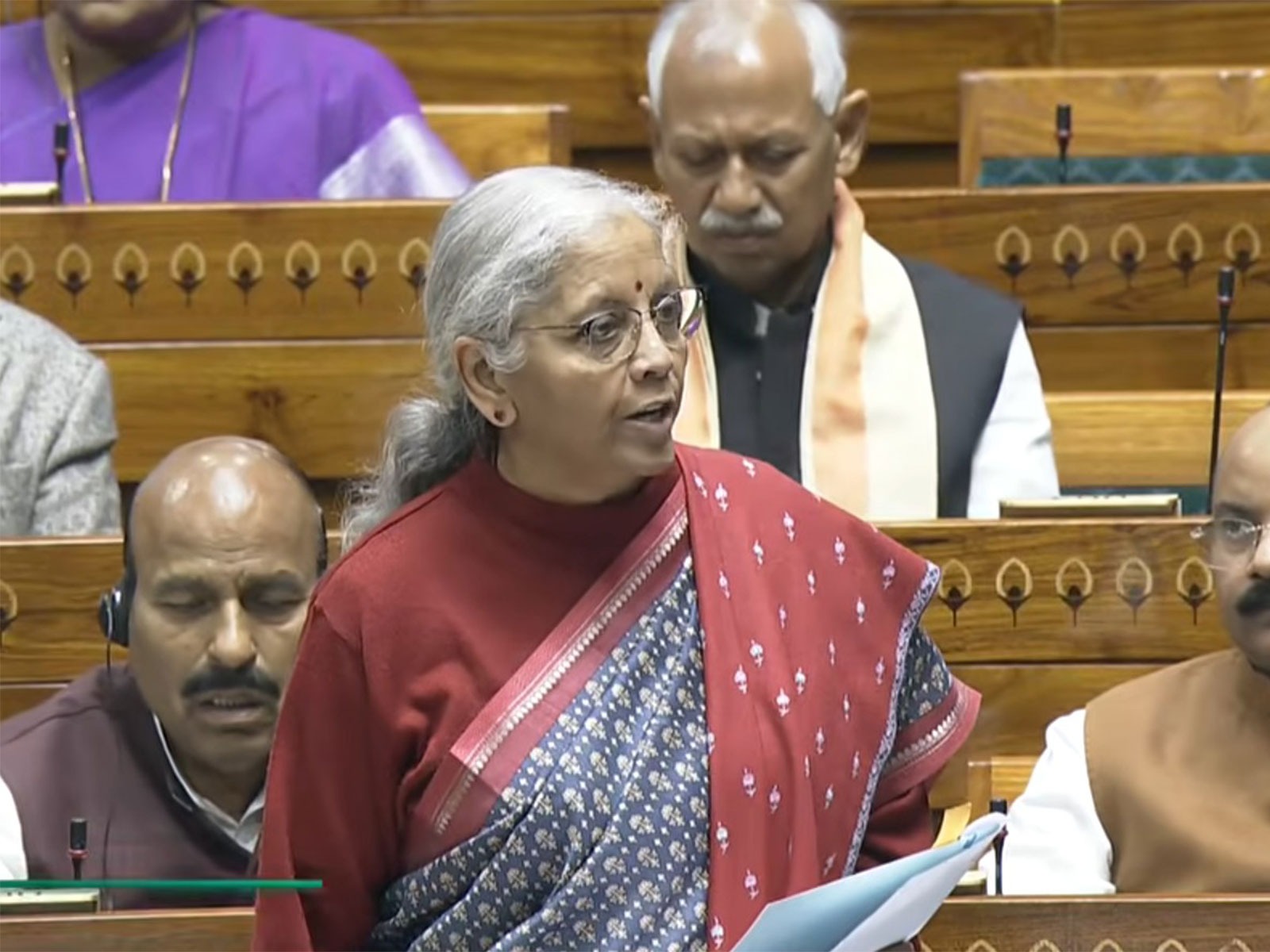

New Delhi [India], December 4 : Finance Minister Nirmala Sitharaman on Wednesday hit back at the Congress leaders who took a jibe at the government over the IMF's annual review of India's national accounts statistics giving the data Grade 'C' and asserted that the IMF report does not question the growth figures. She said that Grade C was assigned because the data is based on an outdated base year, 2011-12, and the new base year will be 2022-23 from next year.

Sitharaman made the remarks during her reply in to the debate on the Central Excise (Amendment) Bill, 2025, which was later passed by the Lok Sabha. The bill is aimed at increasing excise duty on tobacco products and their manufacturing after a discussion.

The Minister said the IMF report focuses mainly on India's overall healthy economic performance and the ratings given by the IMF are part of its report on the Indian economy, which expects India's GDP to grow at 6.5% in 2025-26.

"It recognises growth in the private sector, macroeconomic stability and the resilience of the Indian financial sector. These are identified as key drivers of growth. The IMF also notes that inflation is well below the RBI's tolerance band and is projected to be 4.3% for the full year," she said.

"The point of contention was the quality of data on which the 'C' grade was given. The 'C' grade is assigned to the National Accounts data because it is based on an outdated base year - 2011-12. However, the Government of India is now updating the base year, and from next year, the new base year will be 2022-23. This will come into effect from February 27, 2026. So, the data currently being used is based on the 2011-12 base year, and it is solely for this reason that we have been given a 'C' grade. The IMF report does not question the growth figures," she added.

Congress leaders had slammed the government, saying IMF in its annual review of India's national accounts statistics gave the data Grade 'C' -- the second lowest grade.

"Government must explain why the IMF in its annual review of India's national accounts statistics gave the data Grade 'C' -- the second lowest grade. As I post this comment on Friday night, there is another disturbing fact: as far as I can gather only two English language newspapers carried the news in their print editions. Lok Sabha passes Bill aimed at raising excise duty on tobacco products," former Finance Minister P Chidambaram said in a post on X.

India's real GDP has been estimated to have grown by 8.2 per cent in the July-September quarter of the current financial year 2025-26 over the growth rate of 5.6 per cent in the same quarter of the previous fiscal, according to official data.

The National Statistics Office (NSO), Ministry of Statistics and Programme Implementation (MoSPI), released the Quarterly Estimates of Gross Domestic Product (GDP) for the July-September quarter last month.

Sitharaman said that according to NHA data, between 2014-15 and 2021-22, government health expenditure (GHE) as a percentage of GDP rose from 1.13% to 1.84%.

She said government health expenditure (GHE)'s share of overall government spending also increased from 3.94% to 6.12%. Between 2014 to 2022, per-capita health spending tripled from Rs 1,108 to Rs 3,169.

"Under the Ayushman Bharat-Pradhan Mantri Jan Arogya Yojana, providing financial protection to nearly 55 crore beneficiaries. There have been 9+ crore hospital admissions, resulting in Rs 1.3+ lakh crore worth of free treatments. More than 16,000 Jan Aushadhi Kendras, now present in almost all districts, provide quality generic medicines at affordable prices - often 50-90% cheaper than market rates," she said.

"Under various phases of Mission Indradhanush, 5.46 crore children and 1.32 crore pregnant women have been vaccinated against 12 diseases. This targeted initiative contributed to a significant decline in the Maternal Mortality Ratio, from 130 per lakh live births (2014-16) to 80 (2020). Over the last eleven years, the government has approved or established new AIIMS across several states and set up many new medical colleges, including the first AIIMS in the Northeast, located in Assam. MBBS seats have increased to 1.18 lakh, and 74,000 PG seats have been added since 2014," she added.

The Minister said there is no change in the tax incidence on beedi.

"Not even a single paisa of tax has been increased. The Labour Welfare Scheme for beedi workers has three components - Health, Scholarship, and Housing - and the details are as follows: Health: Health care facilities are provided through 10 hospitals and 279 dispensaries. Reimbursement is available for specialised treatments such as cancer, tuberculosis, heart diseases, and kidney transplantation," she said.

"Scholarship: Financial assistance is provided for the education of children of beedi workers from Class I to college or university, ranging from Rs 1,000 to Rs 25,000 per student per annum depending on the class/course. Housing: A subsidy of Rs 1.50 lakh per beneficiary is provided for the construction of pucca houses under the Revised Integrated Housing Scheme (RIHS) 2016. RIHS has been converged with the Pradhan Mantri Awas Yojana. In addition to this, schemes such as the Public Distribution System, Deen Dayal Antyodaya Yojana, PM SVANidhi, PM Kaushal Vikas Yojana etc also support the welfare of beedi workers," she added.

She said other than what the Finance Commission has recommended for devolution, Prime Minister Narendra Modi, who has himself been a Chief Minister and therefore understands the difficulties of the States- had, after the Covid-19 pandemic, "asked us to create a capital fund to be given to the states".

"This fund is a 50-year interest-free loan, which has been utilised by all states. From 2020 till today, Rs 4.24 lakh crore has been provided to the states. The Finance Commission did not ask us to do this. We always keep the interests of the states in mind, and no state receives less than what the Finance Commission has mandated the Centre to devolve," the minister said.

"This is not a new law, this is not an additional tax or something that the Centre is taking away. Many MPs here observed that this is a Cess. This is not a Cess, this is Excise Duty. Excise duty existed before GST," she added.

The amount will be redistributed to the States as per the Finance Commission's recommendations.

The Central Excise (Amendment) Bill, 2025 seeks to revise excise duties on tobacco and related products after the expiry of the GST compensation cess.

"This is not a new law. This is not an additional tax. This is not some thing that Centre is taking away," Finance Minister Nirmala Sitharaman said in her reply to the discussion on the Bill.

She categorically said excise duty that would be levied and not cess, clearing apprehensions of some members. "This is not a cess," she said.

The minister said that the revenue collected will go to the divisible pool, and will be redistributed again (at the 41%) with the States.

"Many members here made the comment that this is a cess. Excise is not a cess. Excise duty existed before GST. Compensation cess is reverting back to the Centre to be collected as Excise duty, which will be redistributed to the States at the 41% allocated"

Citing WHO report, she said India did not revise specific cess rates even as the average retail prices of cigarettes rose at half the pace of nominal income growth.

Many countries revise tobacco taxes annually, while many link it with inflation, she noted.

"Even in India, prior to GST, tobacco rates were increased annually. This was primarily due to health-related concerns, as higher prices or taxes were intended to act as a deterrent so that people would not get into the habit," she said.

The government is bringing back the excise duty which existed priority to the GST system, she said.

The minister said because of various initiatives taken by the government, acreage under tobacco cultivation of over 1.12 lakh acres (45,323 hectare) moved to other crops between 2018 to 2021-22. It has shifted to sugarcane, groundnut, oil palm, cotton, chilli, maize, onion, pulses, and turmeric, she said.

Sitharaman introduced two bills in Lok Sabha on Monday, the first day of the Winter session of Parliament. She introduced the Central Excise (Amendment) Bill, 2025, and Health Security se National Security Cess Bill, 2025, in Lok Sabha.