Tariff threat over Russian oil puts India at crossroads: GTRI

Jan 05, 2026

New Delhi [India], January 5 : As the United States steps up pressure on countries buying Russian oil, India faces a critical policy choice, with continued ambiguity likely to invite higher trade costs, according to a report by the Global Trade Research Initiative (GTRI).

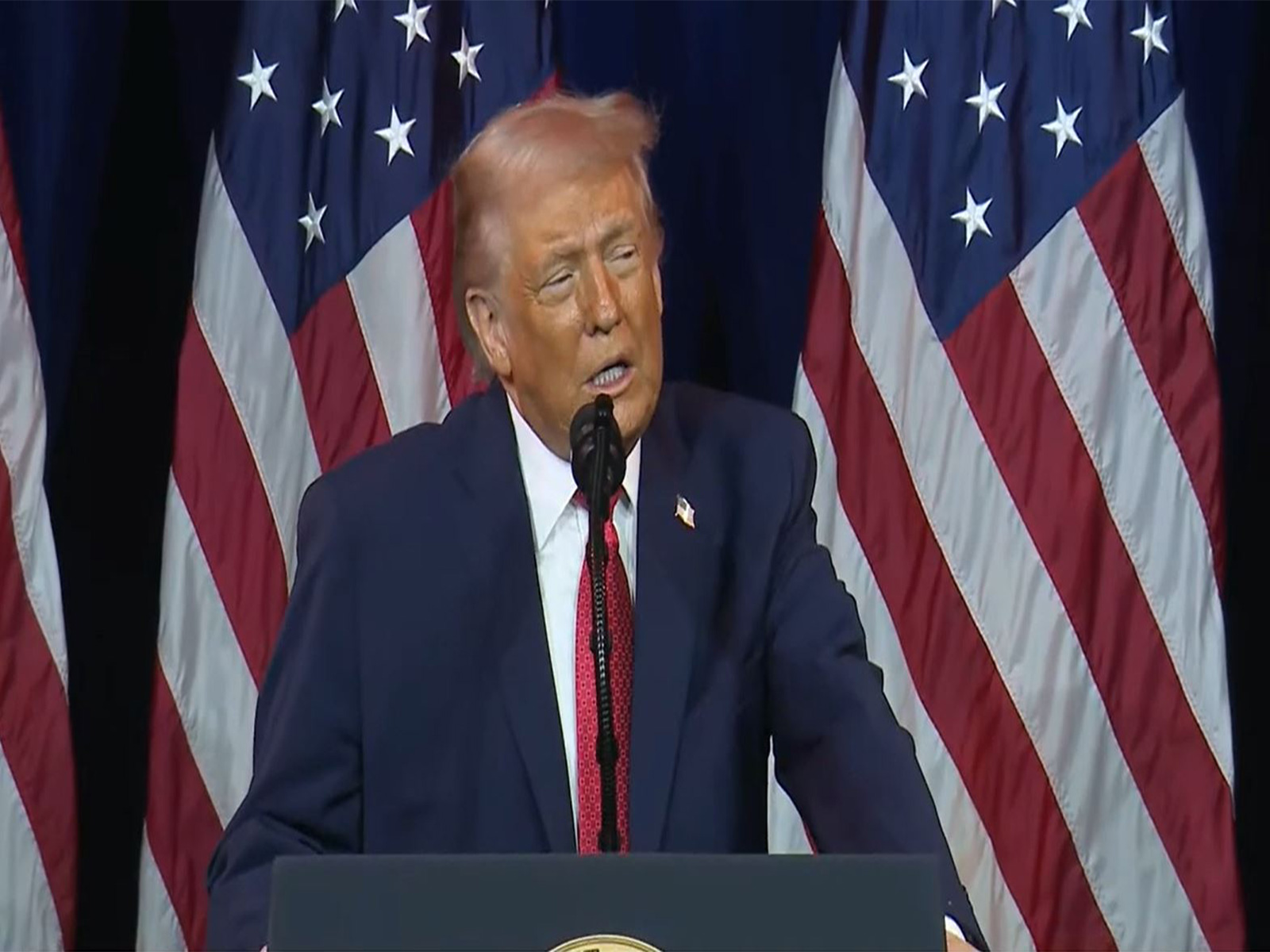

On January 4, US President Donald Trump warned that Washington could raise tariffs on Indian imports if New Delhi does not stop purchasing Russian crude. The warning comes even as Indian exports to the US are already subject to a 50 per cent import tariff, half of which is directly linked to India's Russian oil purchases, the report noted.

The pressure is being reinforced in the US Congress, where Senator Lindsey Graham is pushing legislation to impose secondary tariffs on countries buying Russian oil and gas if Moscow fails to agree to a ceasefire in Ukraine within 50 days.

Following US sanctions imposed in October on Russian energy giants Rosneft and Lukoil, major Indian refiners, including Reliance Industries and several state-owned firms, announced a halt to Russian oil purchases to avoid secondary sanctions. However, imports have not stopped entirely, with lower volumes continuing from non-sanctioned suppliers, placing India in what the report described as a "strategic grey zone."

GTRI said this ambiguity is weakening India's position. "If India plans to stop Russian oil imports, it should do so clearly and decisively. If it intends to continue buying from non-sanctioned suppliers, it must say so openly and support the stance with data," the report said, adding that continued lack of clarity is no longer viable.

The report also cautioned that ending Russian oil imports may not guarantee relief from US pressure, as trade demands could shift to other areas such as agriculture, dairy, digital trade and data governance.

India must also consider that the current tariff pressure is linked to a specific political phase in Washington, which may not last indefinitely, GTRI said. While the European Union, Japan and South Korea chose to cut Russian oil imports to ease tensions with the US, China, the largest buyer of Russian crude, has faced little pressure due to its strategic leverage.

Indian exports to the US have already declined by 20.7 per cent between May and November 2025, and any further tariff escalation could deepen the slowdown, the report warned.

"As the tariff threat hardens, India must take a clean call on Russian oil, own that decision, and communicate it unambiguously to Washington," GTRI said.