"This will be Diwali gift": Shiv Sena leader Shaina NC praises PM Modi's announcment on GST reforms

Aug 15, 2025

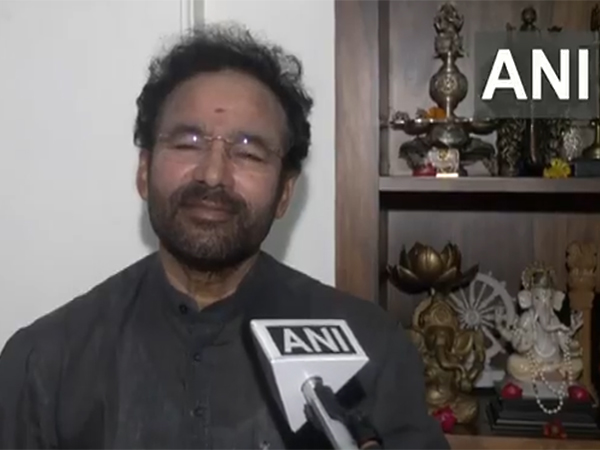

Mumbai (Maharashtra) [India], August 15 : Shiv Sena leader Shaina NC on Friday praised Prime Minister Narendra Modi's announcement on bringing reforms in the Goods and Services Tax (GST).

Shaina NC said that this will be a Diwali gift for the people of the country from PM Modi, and stated that it would be beneficial for the youth and the country.

"Regarding GST reform, the Prime Minister has said that the next generation GST reform will take place. This will be a Diwali gift from him. It will benefit many people. The government is sensitive, and we believe that this Diwali gift is very good for the entire country, especially for the youth," the Shiv Sena leader told ANI.

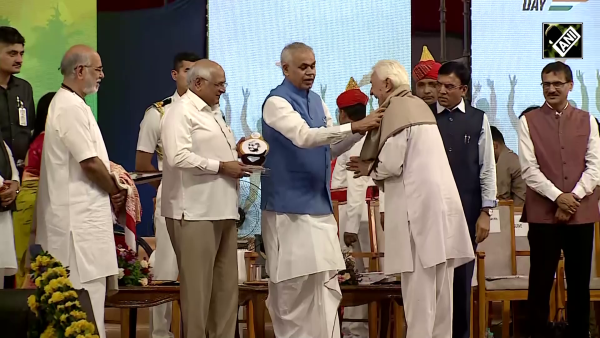

Earlier in the day, Prime Minister Narendra Modi, during his speech on Independence Day, announced that the government was set to bring a major reform in GST, which would give significant relief to consumers and small businesses.

The PM stated that the revisions in the GST would be rolled out around Diwali and described them as a "double Diwali gift" for the people.

"This Diwali, I am going to give you a 'double Diwali' gift. A major announcement is coming for the people of the country. Over the past eight years, we implemented a major GST reform that significantly reduced the tax burden across the nation. Now, after eight years, the time has come to review it. We have formed a high-powered committee to begin this review process and have held consultations with the states as well. We are now bringing in next-generation GST reforms. This will become a Diwali gift for the nation," PM Modi said.

"Tax rates on essential goods and daily needs will be reduced under a simplified framework. This will bring significant relief and convenience. Our MSMEs and small industries will also benefit greatly from these changes," he added.

PM Modi stated that these reforms would directly impact essential goods and daily needs, aiming to ease the tax burden on common citizens.

The move comes at a time when the government is looking to bolster consumption and improve ease of doing business, especially for micro, small and medium enterprises (MSMEs), which have been seeking relief in compliance and tax-related issues.

The implementation of GST replaced a maze of indirect taxes with a single, unified system. It made tax compliance easier, reduced costs for businesses, and allowed goods to move freely across states. By improving transparency and efficiency, GST helped lay the foundation for a stronger, more integrated economy.

On 1 July 2025, the Goods and Services Tax (GST) completed eight years since its rollout in 2017. GST rates in India are determined by the GST Council, which includes representatives from the Union and State or Union Territory governments.

The current GST structure consists of four main rate slabs: 5 per cent, 12 per cent, 18 per cent and 28 per cent. These rates apply to most goods and services across the country.