"This will provide significant relief to middle class": BJP's Tarun Chugh on GST reforms

Sep 22, 2025

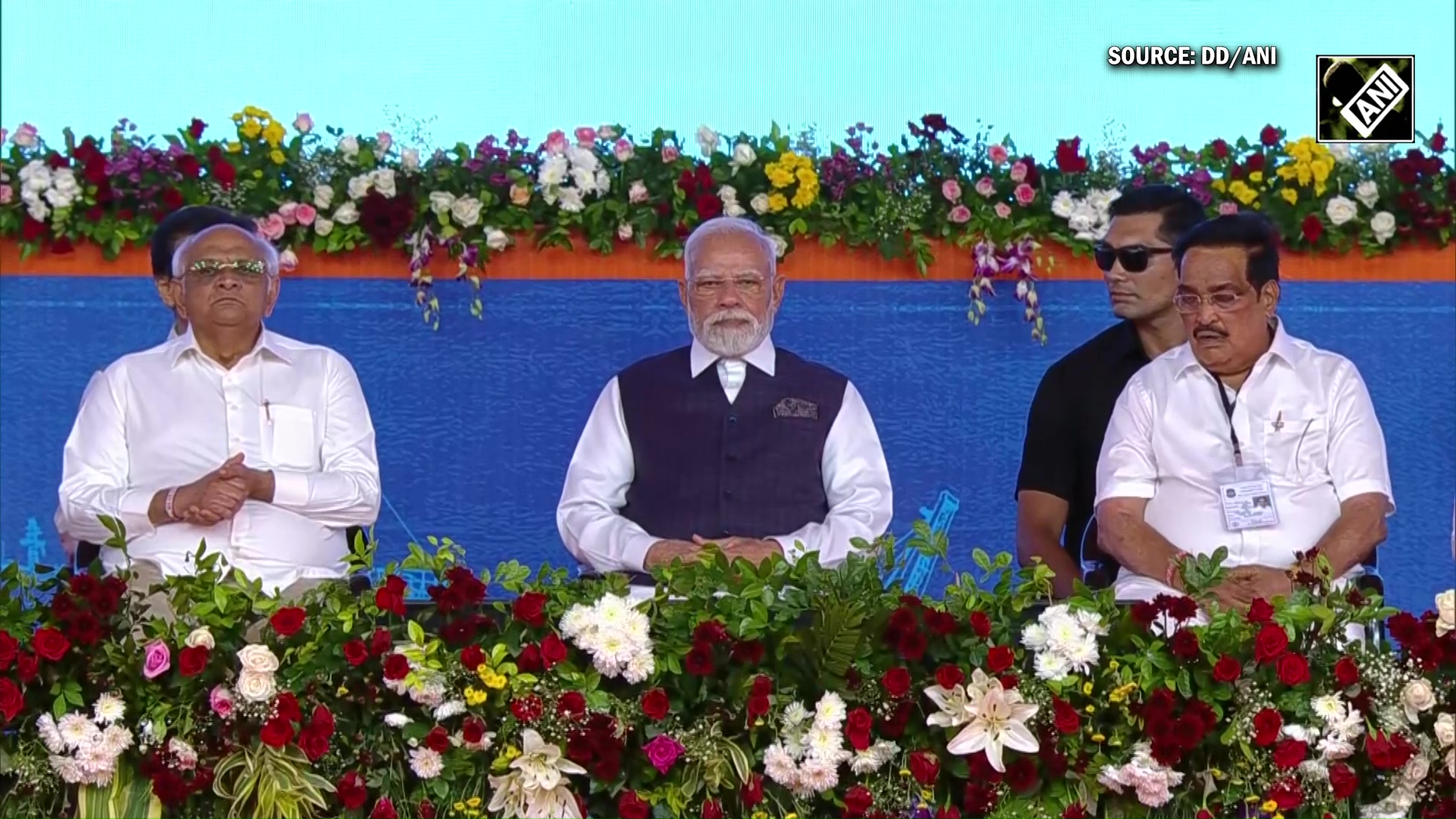

Amritsar (Punjab) [India], September 22 : Terming the GST reforms as a "historic work" done by Prime Minister Narendra Modi, Bharatiya Janata Party leader Tarun Chugh on Monday said that the decision will provide "significant relief" to the middle class.

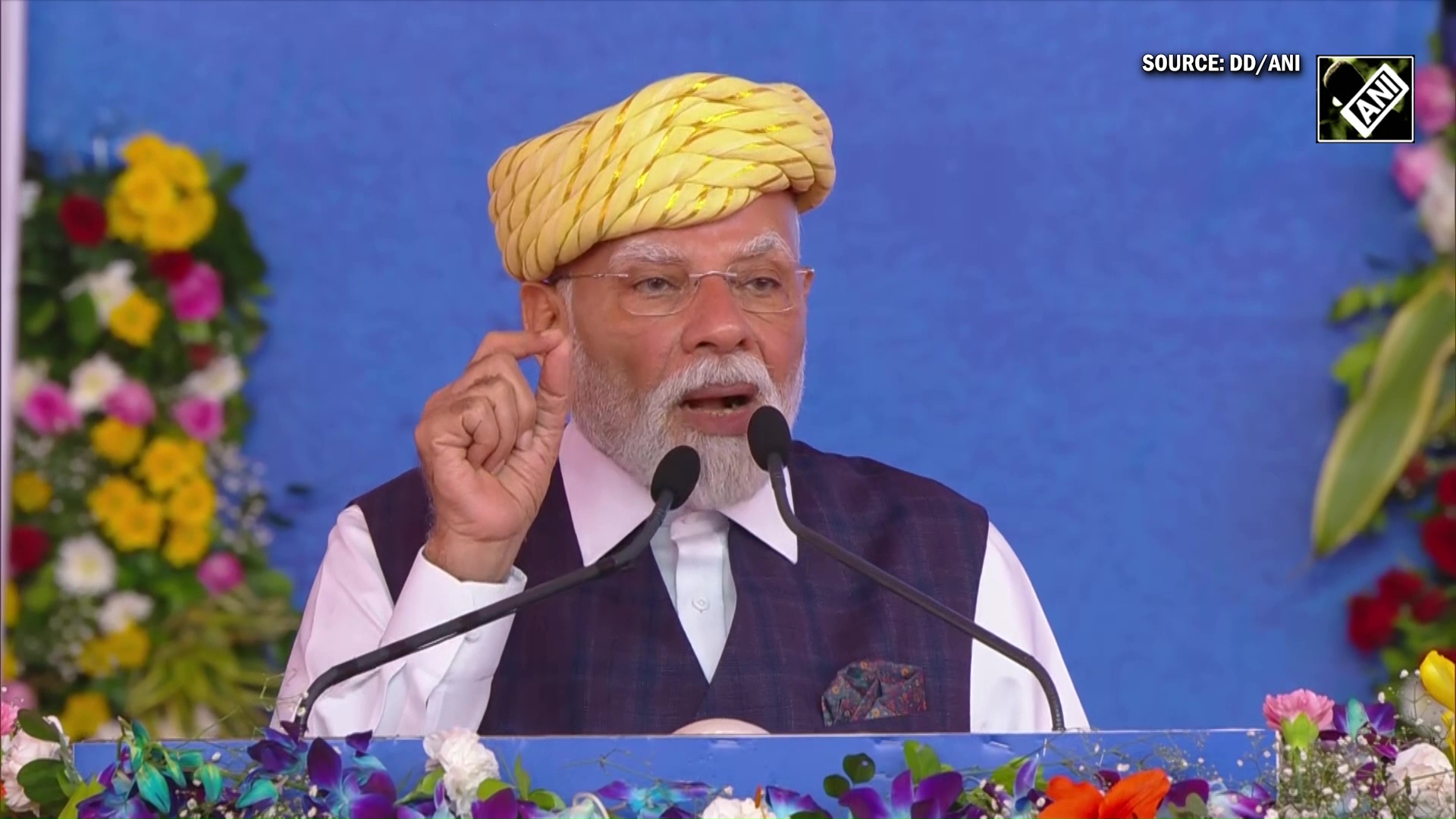

"Prime Minister Modi has done historic work. Almost 2.5 lakh crore rupees have been reduced in GST. These 2.5 lakh crore rupees will become the strength of MSMEs. This will provide significant relief to the middle class... 99% of things have been reduced to a 5% rate... Voices are coming from everywhere that we will promote indigenous products and boost Indian industries," Chugh told ANI.

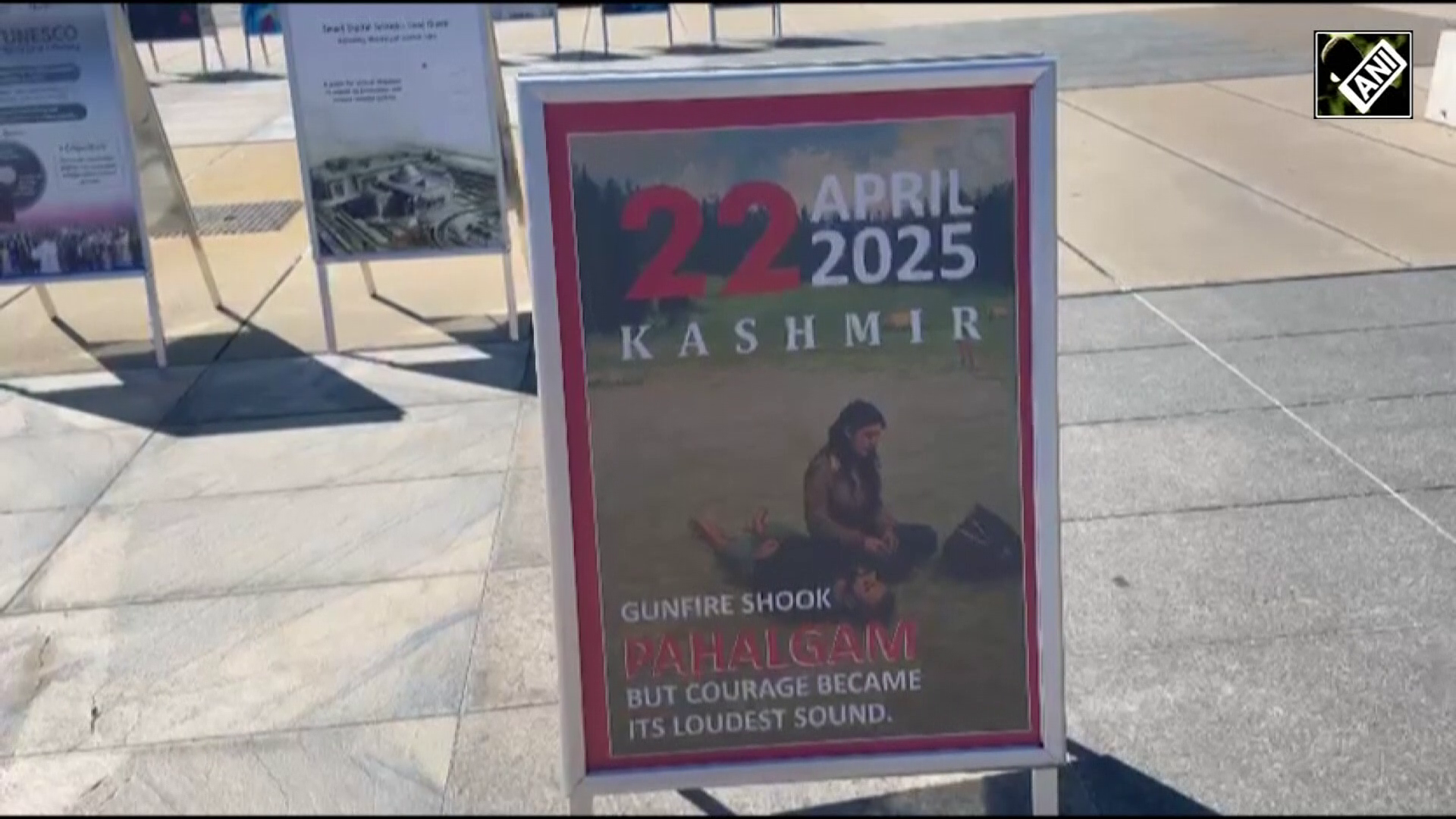

Earlier today, Union Minister Gajendra Singh Shekhawat launched a scathing attack on the opposition for criticising the GST 2.0 reforms and asked, "When did the Opposition ever talk about reforms.

Shekhawat mentioned that the opposition used to call GST "Gabbar Singh Tax".

"The 140 crore people of the country are looking at the GST reforms with enthusiasm. I want to ask, when did the Opposition ever talk about reforms? The Opposition was calling it 'Gabbar Singh Tax'. They used to say that whenever our government comes to power, we will abolish it...It is broadly estimated that more than 2 lakh crore rupees per year will remain in the pockets of the country's general consumers annually," he said.

The reform in the Goods and Services Tax structure, which was approved during the 56th meeting of the GST Council earlier this month, took effect from today. The current four-rate system will be replaced with a streamlined two-slab regime of 5% and 18%. A separate 40 per cent slab has been retained for luxury and sin goods.

This new framework is expected to ease compliance, reduce consumer prices, boost manufacturing, and support a wide range of industries, from agriculture to automobiles and from FMCG to renewable energy. It is intended to lower the cost of living, strengthen MSMEs, widen the tax base, and drive inclusive growth.