Trade deal with US eases uncertainty, strengthens India's debt market: Trustee EPFO

Feb 03, 2026

By Kaushal Verma

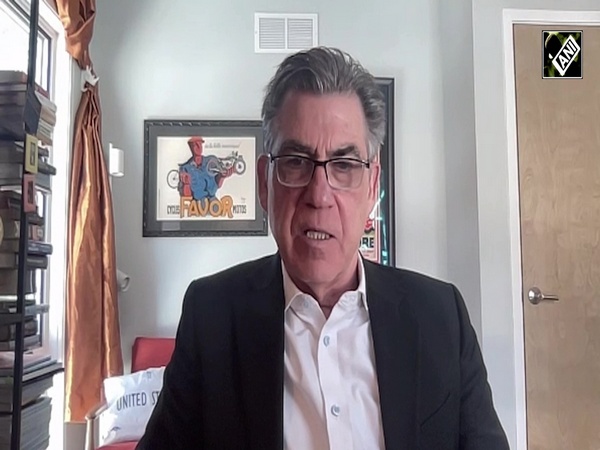

New Delhi [India], February 3 : India's benchmark government bond yield eased as investor sentiment strengthened following the trade deal between the United States and India, says Vineet Nahata, member of the Central Board of Trustees (CBT) of the Employees' Provident Fund Organisation (EPFO) told ANI today. The agreement reduced uncertainty and reinforced confidence in the Indian financial markets.

"The US trade deal which happened yesterday has been symbolised as the father of all deals," Vineet Nahata, member of the Central Board of Trustees (CBT) of the Employees' Provident Fund Organisation (EPFO), told ANI in an interview on the sidelines of a FICCI Conference on Union Budget 2026-27.

Nahata said the tariff rate under the deal had been fixed at 18%, a level he described as favourable for financial markets across debt, equity and foreign exchange. He pointed to a clear reaction in the bond market, where the 10-year government security yield softened after the announcement. According to Nahata, the yield, which had been hovering around 6.77%, declined to about 6.71%, reflecting renewed confidence in Indian sovereign debt.

The easing in yields comes at a time when policymakers are also seeking to deepen the domestic bond market through budgetary measures. Nahata said the Union Budget had provided several incentives aimed specifically at strengthening the Indian debt market and improving its attractiveness to global investors.

Among the measures highlighted was the introduction of market-making mechanisms such as total return swaps. Nahata said these instruments would benefit foreign institutional investors by allowing them to take exposure to Indian corporate debt and sovereign bonds while hedging their risk more efficiently.

He added that such mechanisms could encourage greater participation from overseas investors who had been cautious amid global volatility and trade-related uncertainty.

Nahata also flagged incentives announced for municipal bonds, including interest subvention, as another step towards broadening the debt market. He said these measures would help channel funds into urban infrastructure while offering investors a wider range of fixed-income options.

On the broader market outlook, Nahata said sentiment across debt, equity and foreign exchange markets was already upbeat, and he expected this momentum to continue in the long term. He said the clarity provided by the trade deal had addressed concerns that markets had been grappling with for some time.

"The certainty which the market was craving for all this while has now been achieved by yesterday's deal," he said, adding that this was likely to translate into higher overseas investor participation across asset classes.

Nahata also said the trade deal was expected to have a stabilising effect on the Indian currency, as tariff-related uncertainty had been a key driver of volatility. He said the rupee, which had earlier weakened to around 92 per dollar, could strengthen in the coming weeks, with expectations of a move below 90.

He added that global commodities such as gold and silver had also reacted positively to the deal, noting that their price movements were driven largely by global factors, even though India remained a major market.