"Trying to fill its coffers instead of bringing relief to people": JP Nadda slams Congress-led Himachal government

Oct 01, 2025

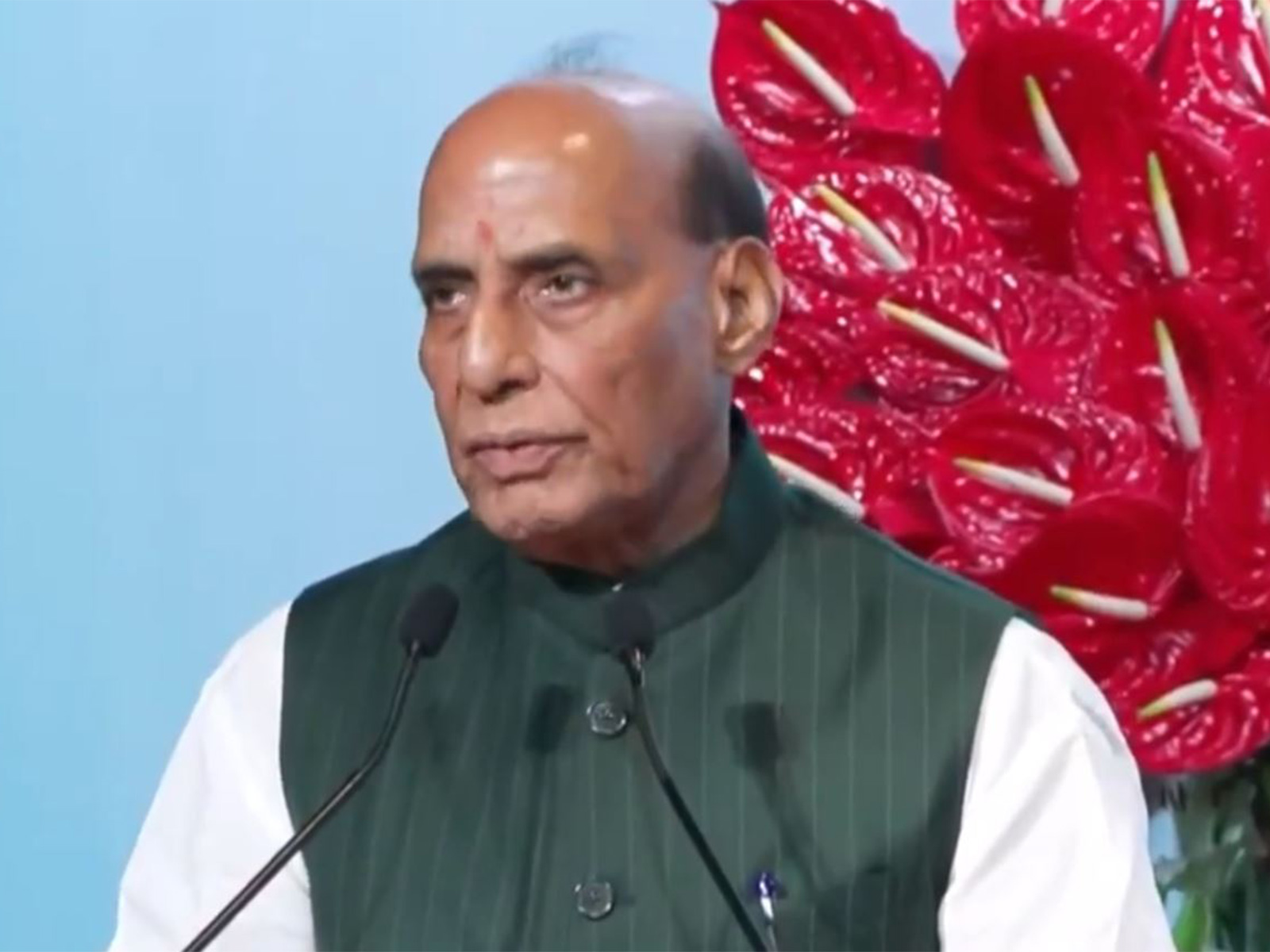

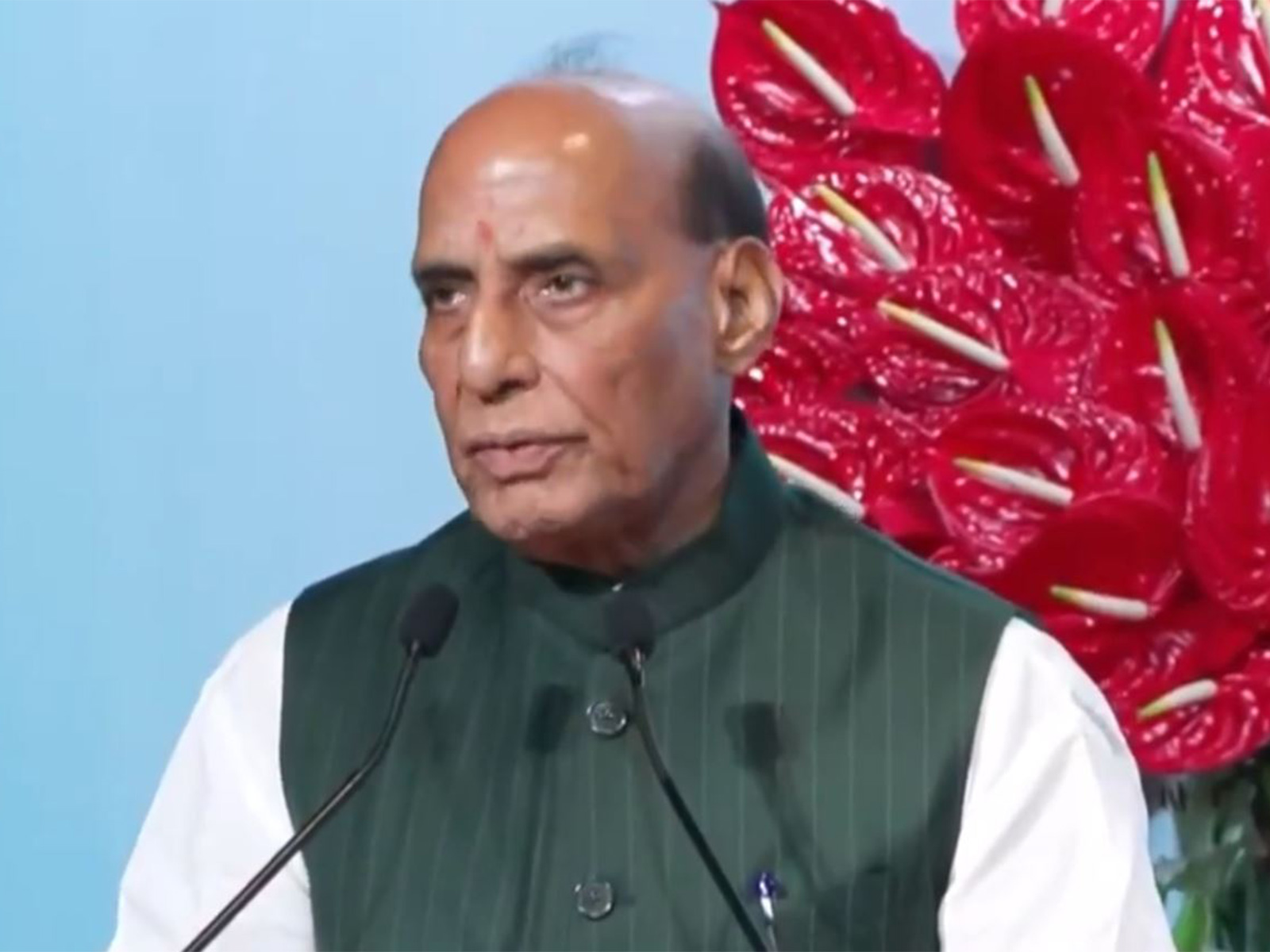

New Delhi [India], October 1 : BJP National President and Union Minister JP Nadda on Wednesday said that while the GST Bachat Utsav brought relief, the Congress government in Himachal Pradesh is increasing cement prices instead of lowering them, thereby burdening people and trying to fill its coffers amid natural disasters.

In a video message, JP Nadda said, "...On one hand there is joy over GST Bachat Utsav, but on the other hand, Congress Govt in Himachal Pradesh is further burdening the public with tax. We know that Himachal Pradesh is trying to come out of the disaster struck by cloudburst, landslides and floods. With the inspiration by PM Modi, keeping in mind the reconstruction in Himachal Pradesh, relief on cement was provided so that the prices of cement fell by Rs 30...Still, people of Himachal Pradesh could not benefit because Congress Govt in Himachal Pradesh increased the price of cement instead of lowering it...When Himachal Pradesh is suffering through natural calamity and financial issues, instead of bringing relief to the common people, Congress Govt is attempting to fill its coffers."

He called it immoral and insensitive that cement made in Himachal Pradesh is being sold at lower prices in neighbouring states, while people in the state face higher costs.

"This is immoral and insensitive. Unfortunately, when cement manufactured in Himachal Pradesh is sold in neighbouring states, it is available at a lower price but in Himachal Pradesh it is being sold at a higher price. Congress Govt is so insensitive that it has raised tax on cement and water bill...Electricity Bill has also been increased. PM Modi wants to bring relief to the people of Himachal Pradesh but Congress Govt is working to trouble them. This is reveals the inhuman face of Congress Govt. The more it is condemned, the less it is...When the time comes people will teach lesson to this anti-people Govt," Nadda said.

The reform in the Goods and Services Tax structure, which was approved during the 56th meeting of the GST Council earlier, came into effect from September 22.

The earlier four-rate system is replaced with a streamlined two-slab regime of 5 per cent and 18 per cent. A separate 40 per cent slab has been retained for luxury and sin goods.