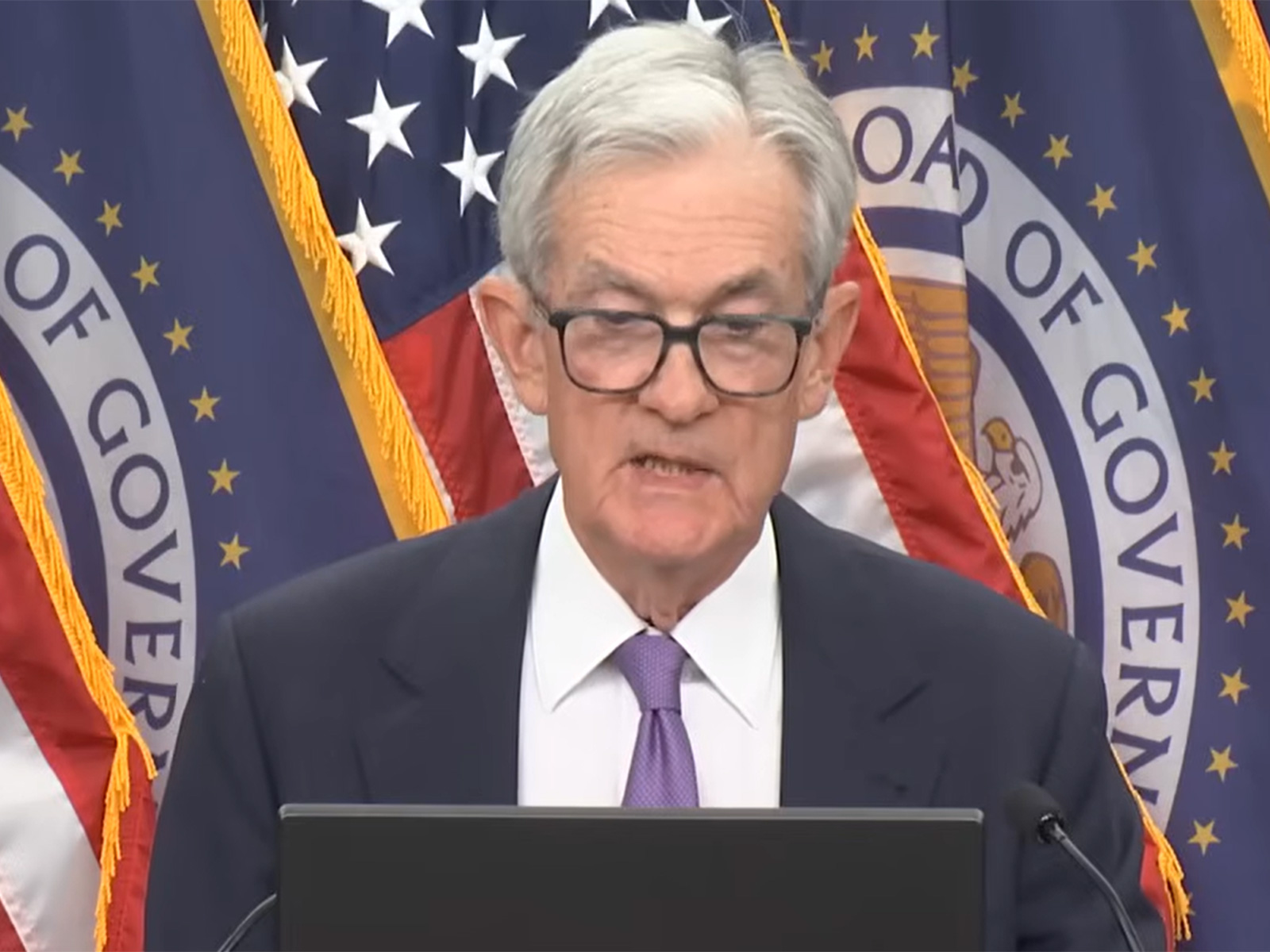

US Fed charts "Goldilocks" path for 2026 as markets weigh dovish signals: DBS

Dec 11, 2025

New Delhi [India] December 11 : The United States Federal Reserve delivered its third consecutive 25-basis-point rate cut, shifting the federal funds rate to 3.75%, in what analysts widely interpreted as a dovish tilt despite persistent inflation and resilient economic activity.

In a report, the DBS Group Research analysts shared three key takeaways from the move.

The Summary of Economic Projections (SEP) indicates Goldilocks in 2026, it said. GDP growth was boosted to 2.3% from previously 1.8% while core PCE inflation was shaved down to 2.5% from 2.6%.

DBS Bank Senior Rates Strategist Eugene Leow highlighted that the dot-plot was kept unchanged one cut each in 2026 and 2027. Third, the purchases of T bills will begin, USD 40bn per month starting 12 December, as the Fed judged that reserves may have fallen too much.

This pace of buying is likely to be maintained for several months before being significantly reduced. This should not be mistaken for QE.

DBS Analysts believe that the market participants interpret the projection as a vote of confidence: the Fed sees the economy navigating through 2026 without significant overheating or recession. Unlike earlier cycles where rate cuts telegraphed alarm, the current trajectory telegraphs controlled normalization.

DBS Chief Economist Taimur Baig noted that the central bank is likely to continue easing in the near term, even amid political noise and uncertainty surrounding potential pressure from the White House as the 2026 election cycle intensifies.

Baig warned that the Fed's ability to keep cutting rates will become increasingly constrained as structural forces such as tariffs, tight immigration, AI-driven energy demand, and tax cuts keep inflation sticky.

On the labour market, the report said, "We don't think the labour market is about to crash, nor do we think that economic growth is likely to stall. From retail sales to investment, growth critical markers point to sustained GDP growth ahead, with demand likely to remain strong, and inflation not about to ease, owing to tariffs, immigration tightness, AI-related demand for energy, and tax cuts, the Fed's window to keep cutting will narrow considerably."