US Fed signals aggressive rate hike: how will it impact Indian economy?

Sep 22, 2022

By Gyanendra Kumar Keshri

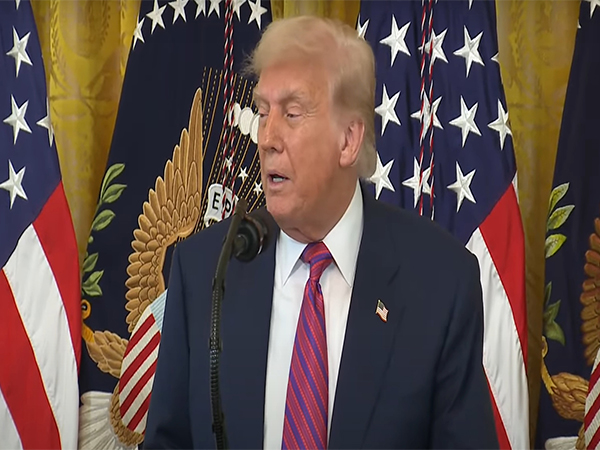

New Delhi [India], September 22 : The Federal Reserve, the central bank of the United States, on Wednesday hiked policy interest rate by 75 basis points. This is the third straight increase in interest rate by the Federal Reserve since June and it has signalled more large increases in the months to come.

How will the aggressive rate hike by the US Federal Reserve impact the Indian economy? A common saying has it that when America sneezes, the rest of the world catches a cold. This is evident from the impact it had on the global equities, currencies, and commodities markets.

The Fed action has already put the global equities markets on the run. The Indian equities markets key indices plunged for the third straight day on Thursday. The 30 stock S&P BSE Sensex slipped 337.06 points or 0.57 per cent to 59,119.72 points. The broader Nifty 50 of the National Stock Exchange fell 88.55 points or 0.5 per cent to close at 17,629.80 points.

The Indian rupee slipped to a record low of 80.86 against a US dollar on Thursday as compared to its previous day's close at 79.97. This is the biggest single-day decline in the value of the rupee in seven months.

The aggressive rate hike by the Federal Reserve will put further pressure on the stock markets. When the interest rate is increased in the US the investors pull assets away from the emerging markets. Due to high interest rate capital flows more toward the American economy.

The difference between the interest rates in India and the United States has narrowed in recent months. This is because the Federal Reserve has been more aggressive in increasing interest rates than the Reserve Bank of India.

The cumulative increase in interest rate by the Federal Reserve is 300 basis points or 3 percentage points. The Fed has increased the rate by 75 basis points thrice since June. On the other hand, the Reserve Bank of India (RBI) has hiked the policy repo rate by 140 basis points since April.

The Board of Governors of the Federal Reserve System voted unanimously to raise the interest rate paid on reserve balances to 3.15 per cent, effective September 22, 2022.

In August the RBI Monetary Policy Committee hiked the repo rate by 50 basis points to 5.40 per cent. The repo rate is the rate at which the central bank lends money to commercial banks.

So far in 2022, the RBI has hiked the policy repo rate thrice. The cumulative increase is 140 basis points or 1.40 per cent. The RBI first hiked the policy repo rate by 40 basis points in April and it was hiked by 50 basis points twice till August.

The US Federal Reserve has also increased the interest rate thrice so far this year. However, the Fed has been more aggressive in hiking interest rates when compared with the RBI. The cumulative increase in interest rate by the US Fed is 300 basis points or 3 per cent.

The policy interest rate gap between the US and India which stood at 3.85 per cent at the beginning of the year has now narrowed to 2.25 per cent.

The aggressive rate hike by the US Fed will force the RBI to go for a sharp increase in repo rate by the RBI. The RBI Monetary Policy Committee is scheduled to meet during September 28-30. The RBI is widely expected to hike the repo rate by 35 to 50 basis points at the end of this month.

Industry body Assocham President Sumant Sinha said 35-50 basis points increase in the benchmark rates seems unavoidable at this point in time given the continuous monetary tightening by the US Federal Reserve and other central banks.

"India is in a sweet spot with growth coming from all quarters and inflation is relatively in control. Softening of crude prices will augur well for the economy and we should start the interest rate cut cycle from the early part of FY24," Sinha said.

"While the Fed has maintained a hawkish stance, the steady pace of rate hikes and the slight improvement in the inflation situation shows that there is reduced pressure on the central bank to act aggressively," Ravindra Rao, head of commodity research at Kotak Securities.

"We may see some correction in the US dollar once the central bank acknowledges improvement in inflation situation. Another challenge for the US dollar could be aggressive tightening by other central banks to control inflation as well as possible central bank interventions to support their currencies," Rao said.

The Indian economy is highly vulnerable to the US Federal Reserve interest rate action. High interest rate in the US will make Indian equities less attractive for foreign investors. It could lead to capital outflow from India. This will put further pressure on the Indian rupee. A weak rupee will make imports costlier leading to further widening in the current account deficit. The trade deficit may widen further. It may lead to prolong imported inflation forcing the RBI to go for an aggressive policy rate hike.