US Federal Reserve hints at potential tax cuts amid shaky job market

Aug 22, 2025

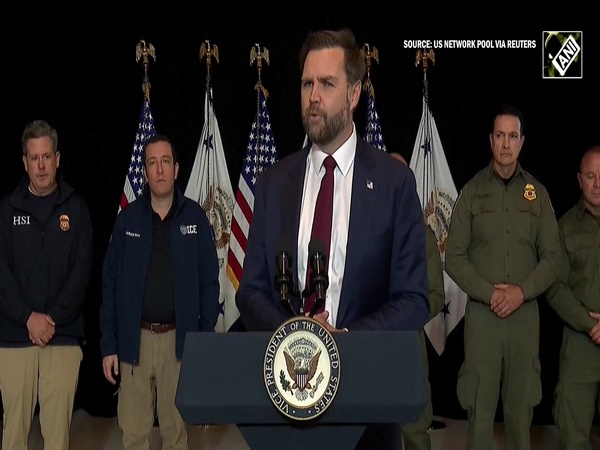

Washington DC [US], August 23 : Chair of the Federal Reserve of the US Jerome Powell said on Friday that the US job market is on such shaky ground that the Federal Reserve may soon need to cut interest rates to support the economy, CNN reported.

In one of his most consequential speeches, Powell suggested the labor market could benefit from lower rates, which the Federal reserve has kept unchanged for eight straight months.

https://x.com/federalreserve/status/1958892674741682266

"Downside risks to employment are rising," Powell said in prepared remarks for his keynote speech at the Federal Reserve Bank of Kansas City's annual economic symposium in Jackson Hole, Wyoming. He said the possibility of Trump's tariffs having only a short-lived effect on inflation is "reasonable," as per CNN.

"With policy in restrictive territory, the baseline outlook and the shifting balance of risks may warrant adjusting our policy stance," he added.

The Jackson Hole conference is typically a major event in the world of central banking in which the Fed chair sets the tone for the rest of the year, but it has a radically different backdrop this year, as reported by CNN.

Powell's Jackson Hole remarks, his last such as Fed chair, come at an inflection point in the central bank's 111-year history. The Fed -- and Powell in particular -- has been subject to an unprecedented onslaught on attacks from the White House since Trump began his second term in January. But now, the Trump administration is expanding its assault on the central bank, CNN reported.

The Justice Department has signaled it plans to investigate Fed Governor Lisa Cook after Federal Housing Finance Agency Director Bill Pulte accused her committing mortgage fraud.

Trump continues to demand massive rate cuts as his administration actively searches for who will replace Powell once his term as chair ends in May 2026. At the same time, he is also slowly reshaping the Fed, as per CNN.

Fed Vice Chair for Supervision Michelle Bowman, whom Trump elevated earlier this year to her current post, is actively reviewing banking regulation and is widely expected to ease rules on the largest banks. Some of the contenders for Fed chair have vowed to downsize the central bank's workforce if they're chosen.