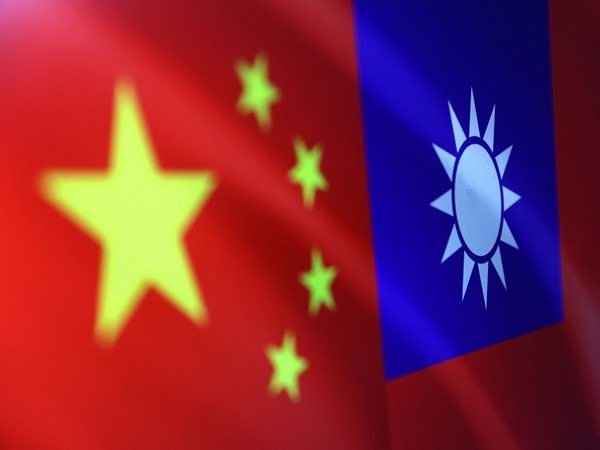

US lawmakers urge SEC to delist Chinese firms tied to CCP, citing national security, investor risks

Jun 25, 2025

Washington DC [US] June 25 : Chairman Moolenaar of the House Select Committee on China, along with Chairman Rick Scott of the Senate Committee on Aging, has addressed a letter to SEC Chairman Paul Atkins, requesting that the Commission initiate the delisting of Chinese firms that pose significant risks to national security and investor protection, as stated in a release by the Select Committee on the CCP (SCCCP).

According to the SCCCP announcement, the correspondence highlights Chinese companies listed on US stock exchanges, such as Alibaba, Baidu, Hesai, and Zeekr, which take advantage of American capital markets while furthering the strategic goals of the Chinese Communist Party (CCP), including military advancement, surveillance, and forced labour.

"These businesses are not merely commercial entities; they are tools of the Chinese Communist Party's wider agenda to undermine US interests," Chairman Moolenaar commented. "The SEC must take decisive action to safeguard American investors and national security," as noted in the release.

Chinese firms listed in the US, like Alibaba, JD.com, and Tencent Music, have associations with the Chinese military or are integrated into China's surveillance system.

Most Americans with 401(k)s or pension plans are unaware that they are invested in these entities. Many use complex structures that obscure ownership, making them difficult to audit, and are protected from revealing their connections with the CCP.

This leaves American investors in the dark. Numerous listed companies are linked to forced labour in Xinjiang or supply technology for the CCP's extensive surveillance of its populace, including Uyghurs and other minority groups. Some firms on US exchanges have contributed to the development of military systems for the People's Liberation Army (PLA), have supported drone warfare initiatives, or facilitated cyber intrusions targeting American infrastructure, as referenced in the release.

The Committee has called on the SEC to utilise the Holding Foreign Companies Accountable Act and Sections 12(j) and 12(k) of the Securities Exchange Act to suspend or delist enterprises that are unable to comply with U.S. law by default.

The SEC possesses the necessary tools to take action, and the letter urges prompt enforcement to ensure US markets do not serve as a financing avenue for America's principal adversary, according to the release.