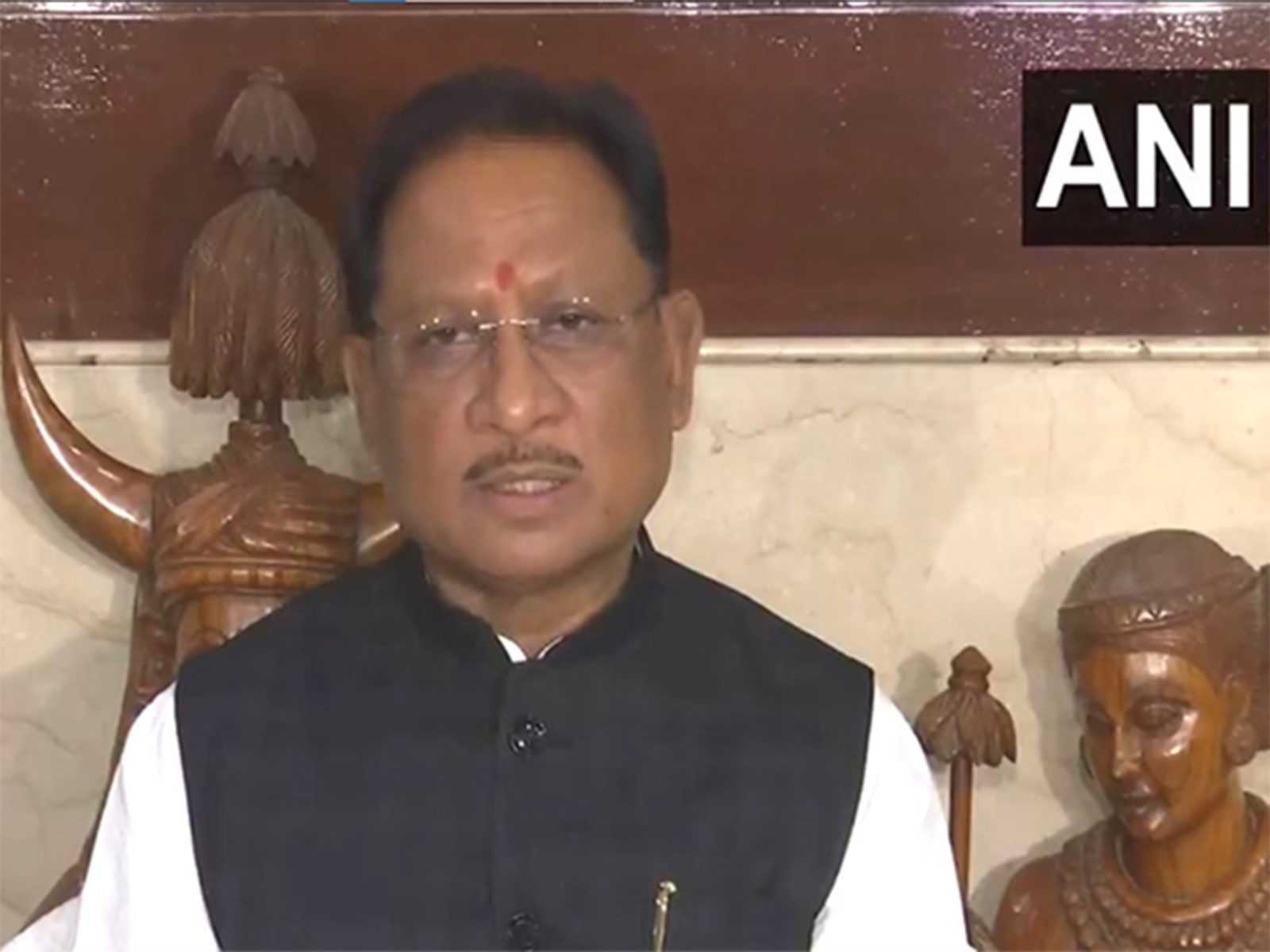

Will benefit industrial sector and our farmers: Chhattisgarh CM Sai welcomes upcoming new GST rates

Sep 21, 2025

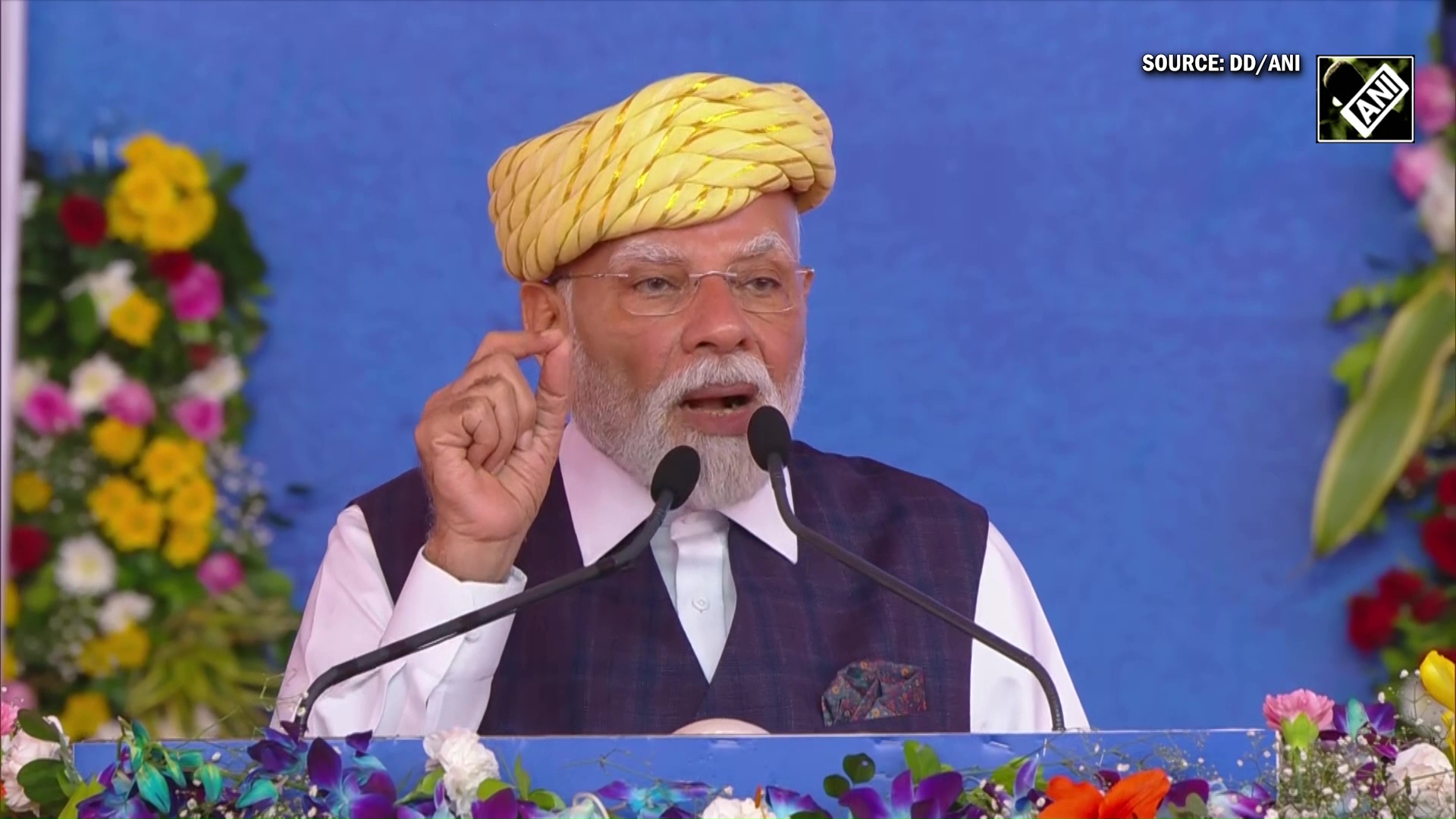

Raipur (Chhattisgarh) [India], September 21 : Chhattisgarh Chief Minister Vishnu Deo Sai on Sunday welcomed the new GST rates coming into effect nationwide from September 22, stating that the reforms would benefit the industrial sector and the farmers.

Speaking to reporters, Sai said, "Its impact will be visible everywhere from tomorrow because the four GST slabs have been reduced to two; now there are slabs of 5% and 18%. This will benefit the industrial sector, and our farmer brothers and sisters will also benefit greatly; the cost of agriculture will also reduce, and farmers will benefit."

Earlier this month, the 56th GST council meeting decided to rationalise GST rates to two slabs of 5 per cent and 18 per cent by merging the 12 per cent and 28 per cent rates.

5 per cent slab consists of essential goods and services, including food and kitchen item like butter, ghee, cheese, dairy spreads, pre-packaged namkeens, bhujia, mixtures, and utensils; agricultural equipment like drip irrigation systems, sprinklers, bio-pesticides, micronutrients, soil preparation machines, harvesting tools, tractors, and tractor tyres; handicrafts and small industries like sewing machines and their parts; and health and wellness like medical equipment and diagnostic kits.

While the 18 per cent slab consists of a standard rate for most goods and services, including automobiles such as small cars and motorcycles (up to 350 cc), consumer goods like electronic items, household goods, and some professional services, a uniform 18 per cent rate applies to all auto parts.

Additionally, there is a 40 per cent slab for luxury and sin goods, including tobacco and pan Masala, products such as cigarettes, bidis, and aerated sugary beverages, as well as luxury vehicles, high-end motorcycles above 350 cc, yachts, and helicopters.

Moreover, some essential services and educational items are fully exempted from GST, including individual health, family floater and life insurance, no GST on health and life insurance premiums, education and healthcare, and certain services related to education and healthcare are GST-exempt.