"Will strengthen the vision of 'One Nation, One Tax, One Market," Haryana CM hails GST reforms

Sep 06, 2025

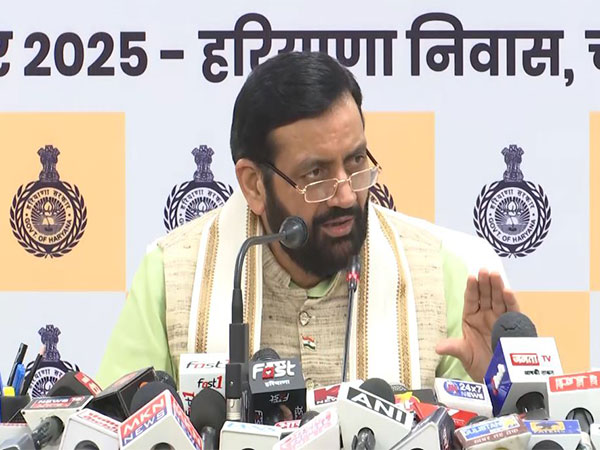

Chandigarh (Haryana) [India], September 6 : Haryana Chief Minister Nayab Singh Saini on Saturday hailed the "historic" decisions taken at the 56th GST Council meeting, chaired by Union Finance Minister Nirmala Sitharaman, under the guidance of Prime Minister Narendra Modi.

Speaking at a press conference, Saini said the reforms align with the vision of 'One Nation, One Tax, One Market,' aimed at reducing classification.

"Under the guidance of Prime Minister Narendra Modi, the 56th GST Council meeting made historic decisions. These steps strengthen the vision of 'One Nation, One Tax, One Market,' reducing classification disputes and litigation for taxpayers. I warmly welcome the reforms introduced during the GST Council meeting, chaired by our Finance Minister, Nirmala Sitharaman," he said.

The Chief Minister said that GST Council has exempted GST on daily food items like roti and paratha, reducing the tax rate to "zero."

"These changes will help curb inflation and provide relief to those in need. It is for the first time, both industrialists and the common public have appreciated and embraced these reforms. The Council has also decided to exempt GST on daily food items like roti and paratha, bringing the tax rate to zero," he added.

Additionally, Saini noted that the GST on agricultural tools, including irrigation and ploughing machinery, as well as pesticides, has been slashed from 12% to 5%.

"This move will support our traditional food businesses and boost Haryana's food processing sector. Additionally, the GST on agricultural tools like Irrigation and ploughing machinery equipment, as well as pesticides, has been reduced from 12% to 5% GST. There is also reduction in tax rate on tractors and tractor parts and also Solar energy equipment also cheaper"

Nayab Singh further stated that, "We have reduced the GST on essential life-saving medicines and life and health insurance to zero percent."

He elaborated, "The GST on life-saving medicines has been brought down from 12% to zero, while medical devices will now attract a reduced GST rate of 5%. Additionally, the GST on life and health insurance has been slashed from 18% to zero, ensuring greater affordability and access to critical healthcare services for the people."