"Bad decision being corrected, not being apologised for": Aaditya Thackeray accuses government of marketing GST rationalization "as gift"

Sep 05, 2025

New Delhi [India], September 5 : Shiv Sena (UBT) leader Aaditya Thackeray on Friday slammed the Modi government, saying that GST rationalisation was a "bad decision being corrected" and instead of being apologetic, it is "arrogantly being marketed as a gift".

The GST rationalisation and simplification was announced by Finance Minister Nirmala Sitharaman on September 3.

Aaditya Thackeray said that the government had imposed wrong GST structure and had sought to correct it.

He said that rationalisation is not a reform and hoped the states will get their dues "without political bias".

"A wrongly imposed GST pattern, the entire making and mistake of the BJP Union Government, now when corrected... The government spends crores on marketing as a "gift" to the citizens! A bad decision being corrected after making a dent, not being apologised for, but arrogantly being marketed as a gift is as absurd as it can get!,"

https://x.com/AUThackeray/status/1963896634573459567

"It isn't a reform, it is wrong decision making and bad governance seeing a tiny correction without apology! At least now I hope that the Union Government will give back the States their dues in time, without political bias!" he added.

The 56th GST Council meeting decided to rationalise GST rates largely to two slabs of 5 per cent and 18 per cent by merging 2 per cent and 28 per cent rates.

Earlier in the day, Union Finance Minister Nirmala Sitharaman said that the foremost priority of the government is to ensure that the benefits of the GST tax reforms reach all the people of the country.

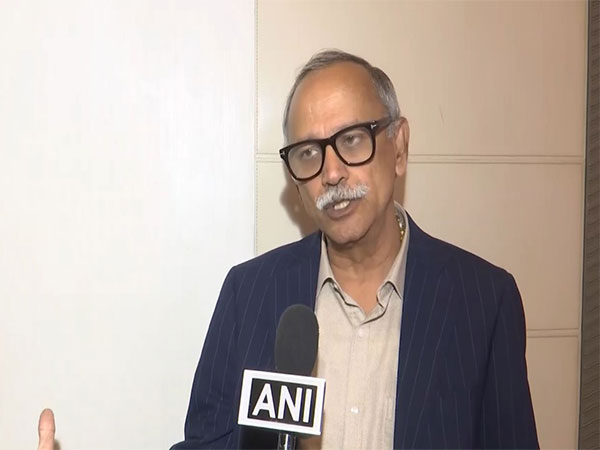

Union Commerce and Industry Minister Piyush Goyal addressed a press conference at the BJP headquarters and termed the GST reforms as a "streamlined taxation", crediting Prime Minister Narendra Modi's leadership over the decision.

"Every state, including those ruled by opposition parties, came together to decide on GST slabs and implement the reform. Even during the COVID-19 pandemic, the Modi government provided compensation for five years (to states). PM Modi aims to simplify taxation for ease of doing business, marking a significant transformation. This change will have a large scope, making FMCG, cosmetics, bread, food items, and daily essentials cheaper, benefiting the poor, middle class, farmers, and women. Unlike the Congress tenure, which had multiple taxes like VAT and central tax, today we've streamlined taxation," Goyal said.