Diwali bonanza for consumers: Centre slashes GST rates across sectors, hundreds of items to get cheaper from Sep 22

Sep 03, 2025

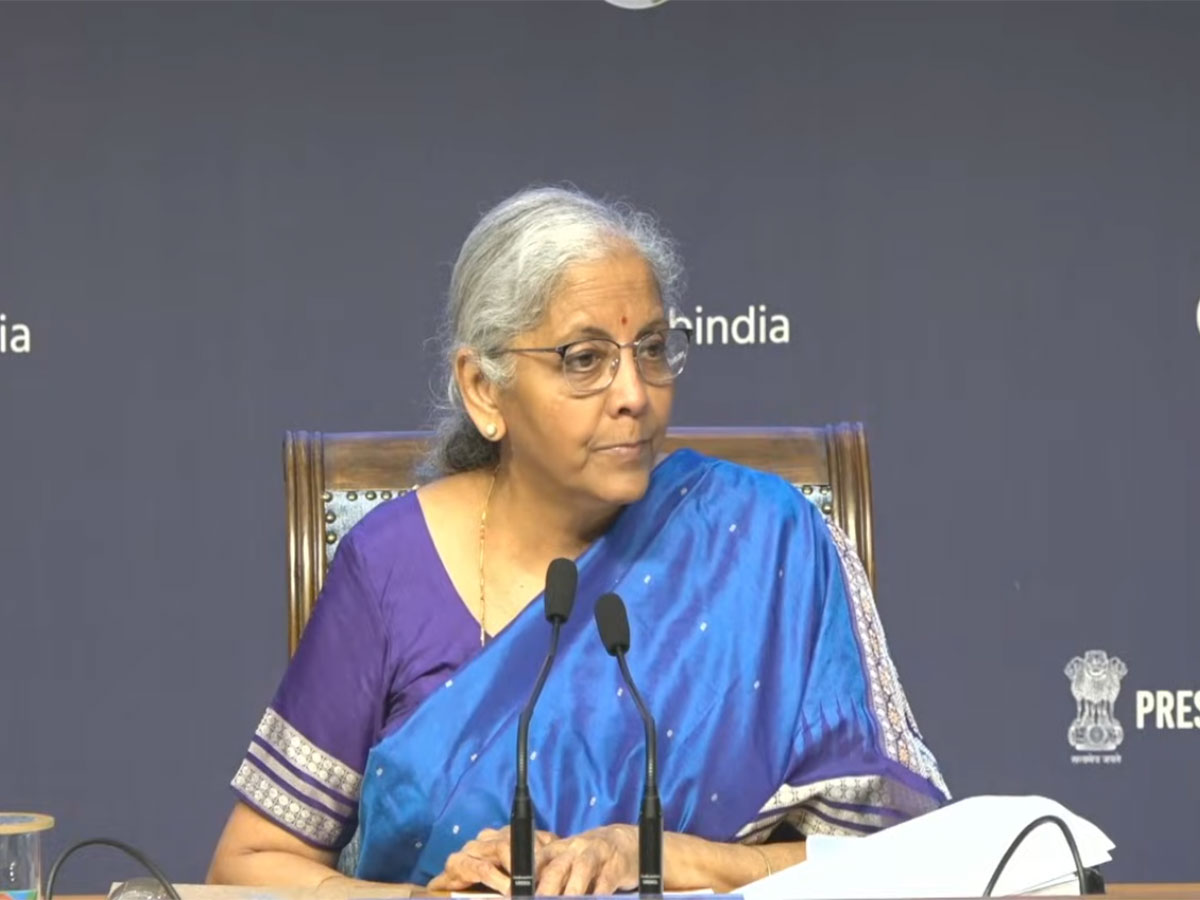

New Delhi [India], September 4 : In a major economic boost ahead of Diwali, the GST Council on Wednesday approved rate rationalisation with a focus on common-man, labour-intensive industries, farmers and agriculture, health and other key drivers of the economy.

According to the press release by the Ministry of Finance, exemption of GST on all individual life insurance policies, whether term life, ULIP or endowment policies and reinsurance thereof, to make insurance affordable for the common man and increase the insurance coverage in the country.

Exemption of GST on all individual health insurance policies, including family floater policies and policies for senior citizens, and reinsurance thereof, to make insurance affordable for the common man and increase the insurance coverage in the country.

Next-generation GST reforms, as announced by Prime Minister Narendra Modi from the ramparts of Red Fort on August 15, represent a strategic, principled, and citizen-centric evolution of a landmark tax framework, which will enhance the quality of life of every last citizen, the press release said.

GST Council approved reforms with a multi-sectoral and multi-thematic focus on improving the lives of all citizens and ensuring ease of doing business for all, including small traders and businessmen.

Rationalisation of the current 4-tiered tax rate structure into a citizen-friendly 'Simple Tax' - a two-rate structure with a Standard Rate of 18 per cent and a Merit Rate of 5 per cent; a special de-merit rate of 40 per cent for a select few goods and services.

GST has been reduced from 18 per cent or 12 per cent to 5 per cent on a host of common man items such as hair oil, toilet soap bars, shampoos, toothbrushes, toothpaste, Bicycles, Tableware, kitchenware, and other household articles.

According to the release, GST has been reduced from 5 per cent to NIL on Ultra-High Temperature (UHT) milk, Prepackaged and labelled chena or paneer; all the Indian Breads will see NIL rates (Chapati or roti, paratha, parotta, etc)

From 12 per cent OR 18 per cent to 5 per cent, GST has been reduced on almost all of the food items, such as packaged namkeens, Bhujia, Sauces, Pasta, Instant Noodles, Chocolates, Coffee, Preserved Meat, Cornflakes, Butter, Ghee, etc.

According to the release, GST on Air-conditioning machines, TVs 32 inch (all TVs now at 18per cent), Dishwashing machines, Small cars, and Motorcycles equal to or less than 350 CC were lowered from 28 per cent to 18 per cent

Reduction of GST from 12 per cent to 5 per cent on agricultural goods, such as tractors, agricultural, horticultural or forestry machinery for soil preparation or cultivation, harvesting or threshing machinery, including straw or fodder balers, grass or hay mowers, composting machines, etc, the release said.

Reduction of GST from 12 per cent to 5 per cent on labour-intensive goods such as Handicrafts, Marble and travertine blocks, granite blocks, and Intermediate leather goods, while on Cement, GST has been lowered from 28 per cent to 18 per cent

12 per cent GST on 33 lifesaving drugs and medicines has been reduced to NIL and from 5 per cent to NIL on 3 lifesaving drugs & medicines used for treatment of cancer, rare diseases and other severe chronic diseases, the release said.

GST on all other drugs and medicines will now be 5 per cent and on various medical apparatus and devices used for medical, surgical, dental or veterinary usage or for physical or chemical analysis, the GST has been lowered to 5 per cent, and same for the various medical equipment and supplies devices such as wadding gauze, bandages, diagnostic kits and reagents, blood glucose monitoring system (Glucometer) medical devices, etc, the release said.

GST on Small Cars and Motorcycles equal to or below 350cc will be 18 per cent as compared to the earlier 28 per cent.

The Council announced a reduction of GST from 28 per cent to 18 per cent on buses, trucks and ambulances.

There will be a uniform rate of 18 per cent on all auto parts irrespective of their HS code; Three-Wheelers from 28 per cent to 18 per cent

The GST Council announced a correction of long-pending inverted duty structure for the manmade textile sector by reducing GST rate on manmade fibre from 18 per cent to 5 per cent and manmade yarn from 12 per cent to 5per cent. A correction of the inverted duty structure was announced in the fertiliser sector by reducing GST from 18 per cent to 5 per cent on Sulphuric acid, Nitric acid and Ammonia, the release stated.

GST Council recommended operationalisation of Goods and Services Tax Appellate Tribunal (GSTAT) for accepting appeals before the end of September, and to commence hearing before the end of December 2025, and the GST rates on services will be implemented with effect from September 22.

Prime Minister Narendra Modi on Wednesday stated that the wide-ranging reforms will enhance the lives of citizens and ensure ease of doing business for all, particularly small traders and businesses.

In a post on X, PM Modi said, "During my Independence Day Speech, I had spoken about our intention to bring the Next-Generation reforms in GST. The Union Government had prepared a detailed proposal for broad-based GST rate rationalisation and process reforms, aimed at ease of living for the common man and strengthening the economy."

"Glad to state that @GST_Council, comprising the Union and the States, has collectively agreed to the proposals submitted by the Union Government on GST rate cuts & reforms, which will benefit the common man, farmers, MSMEs, middle-class, women and youth. The wide ranging reforms will improve lives of our citizens and ensure ease of doing business for all, especially small traders and businesses," PM Modi added in his post.