"Historic decision": Union Ministers Amit Shah, Rajnath Singh laud PM Modi for GST reforms

Sep 03, 2025

New Delhi [India], September 4 : Union Home Minister Amit Shah lauded Prime Minister Narendra Modi for the GST reforms and called it a "historic decision" to cut tax rates.

Shah said that the GST reforms will bring "huge relief" to the poor, middle class, farmers, MSMEs, women and youth.

Sharing an X post on Wednesday, Amit Shah wrote, "PM Narendra Modi Ji stands for what he commits. This historic decision of GST rate cuts and process reforms will bring huge relief to the poor and middle class, while also supporting farmers, MSMEs, women and youth."

The Union Minister also hailed the GST Council's decision to introduce a simplified Goods and Services Tax (GST) registration scheme.

"By simplifying the system and reducing the burden on common citizens, these reforms will not only ensure ease of living but also give a big boost to ease of doing business, especially for small traders and entrepreneurs. A truly transformative decision for Bharat," the X post added.

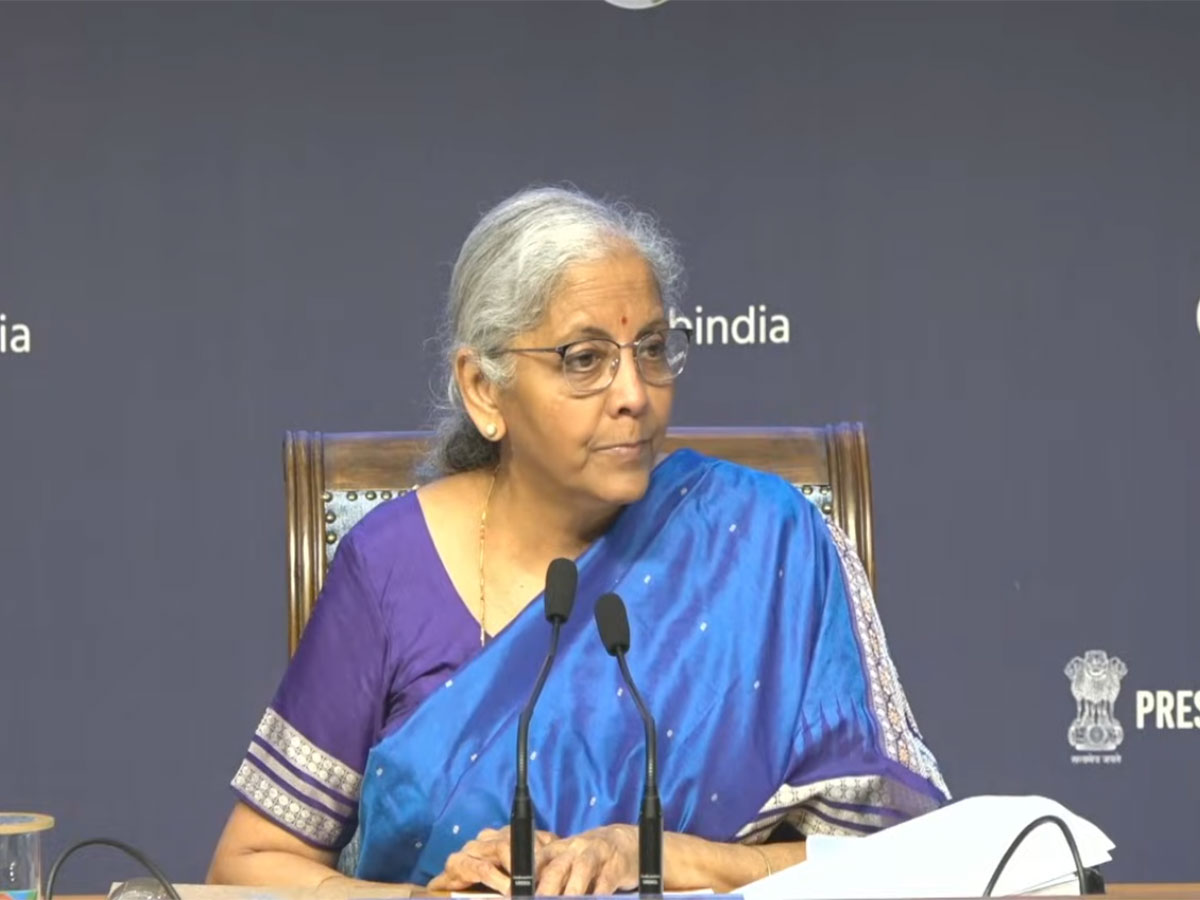

Defence Minister Rajnath Singh also lauded PM Modi and Finance Minister Nirmala Sitharaman for the "bold decision" on GST reforms.

"The Government of India, under the leadership of PM Narendra Modi, has announced the Next-Gen GST reforms to bring relief across sectors. With tax rates reduced on many important items, this reform will bring ease of living, further strengthen ease of doing business, empower small businesses, and boost India's self-reliance under Aatmanirbhar Bharat. I thank PM Modi and the FM Nirmala Sitharaman for taking this bold decision," Rajnath Singh wrote on X.

Earlier, the GST Council, after a threadbare discussion, approved significant rate cuts across multiple sectors, which the government has described as a Diwali gift for the nation. Finance Minister Nirmala Sitharaman made the announcements.

On the essential items front, items of daily household use will now cost less. Products such as hair oil, shampoo, toothpaste, toilet soap bars, toothbrushes, and shaving cream, which earlier attracted 18 per cent GST, will now fall under the 5 per cent bracket.

Sewing machines and their parts, previously taxed at 12 per cent, will now attract only 5 per cent GST.

Farmers and the agriculture sector stand to gain significantly from these reforms as tractor tyres and parts, earlier under 18 per cent GST, will now be taxed at just 5 per cent, while tractors themselves will also see their rate reduced from 12 per cent to 5 per cent.