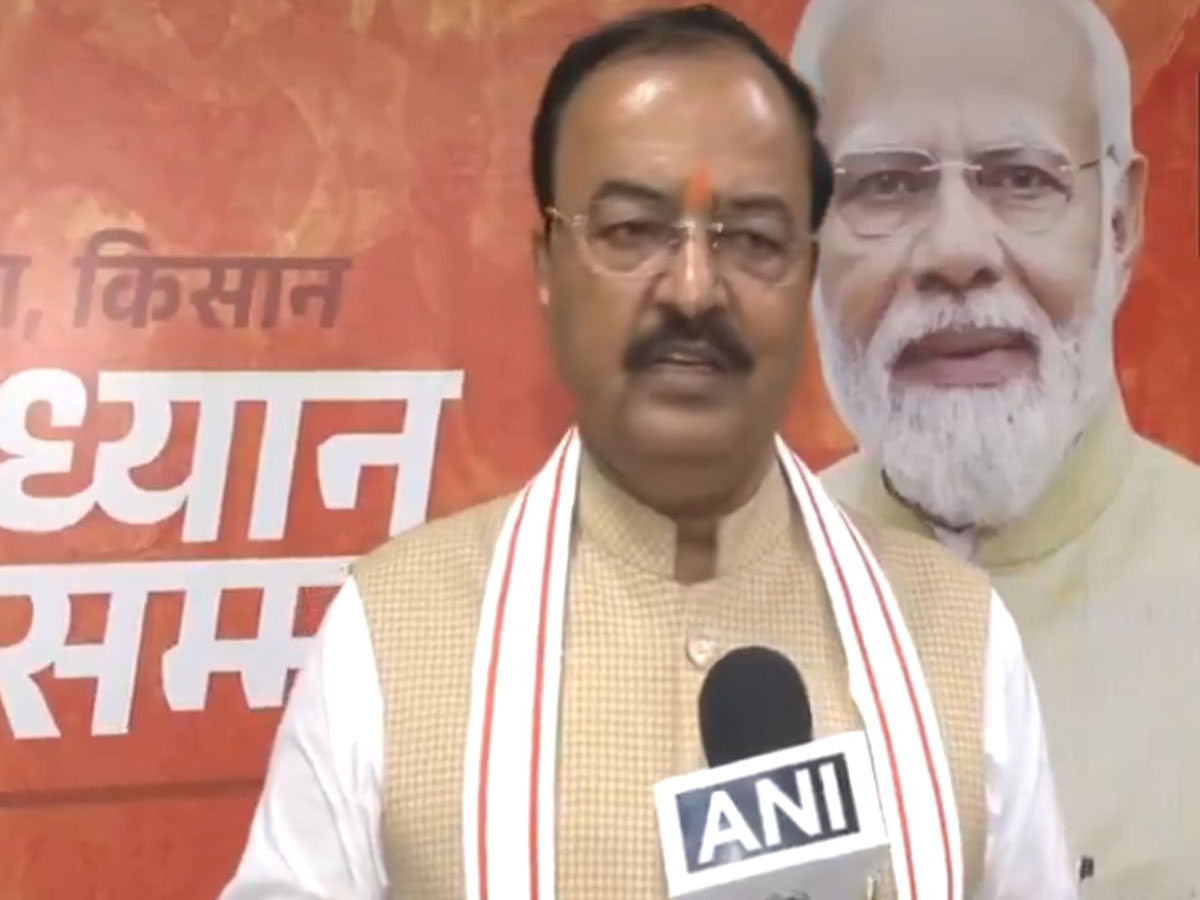

"Historic step towards making India self-reliant": UP DyCM Maurya hails GST reforms

Sep 04, 2025

Lucknow (Uttar Pradesh) [India], September 5 : Uttar Pradesh Deputy Chief Minister Keshav Prasad Maurya on Thursday welcomed the Goods and Services Tax (GST) reforms, calling it a "big and historic step."

"On August 15, from the ramparts of the Red Fort, Prime Minister Modi had announced this, and it was fulfilled within 18 days. The GST Council has prepared a new slab... GST has been reduced on many products. GST on health insurance and life insurance has been made zero... This is a big and historic step towards making India self-reliant. We should not import, but export, and all the needs of our country should be met by products manufactured in our country. I welcome this decision and thank the Prime Minister and the Finance Minister," Maurya told ANI.

He further mocked Congress, stating that they were 'desperate' and 'disappointed,' and opposed things that should be welcomed.

"The Congress is desperate, disappointed, and in a state of exile, so they oppose even those things that should be welcomed..." he further added.

The 56th GST council meeting decided to rationalise GST rates to two slabs of 5 per cent and 18 per cent by merging the 12 per cent and 28 per cent rates.

Union Finance Minister Nirmala Sitharaman announced the decision on September 3, after she chaired the GST council meeting. This has reduced the previous GST slabs from 5 per cent, which consisted of essential goods and services, including food and kitchen items, agricultural equipment, handicrafts and small industries, and also medical equipment and diagnostic kits.

While the 18 per cent slab consists of a standard rate for most goods and services, including automobiles such as small cars and motorcycles (up to 350cc), consumer goods like electronic items, household goods, and some professional services.

Additionally, there is a 40 per cent slab for luxury and sin goods, including tobacco and pan Masala, products such as cigarettes, bidis, and aerated sugary beverages, as well as luxury vehicles, high-end motorcycles above 350cc, yachts, and helicopters.

Notably, some essential services and educational items are fully exempt from GST, including individual health, family floater, and life insurance.