No sector remains "untouched": Gujarat Minister Rushikesh Patel applauds newly introduced GST reforms

Sep 04, 2025

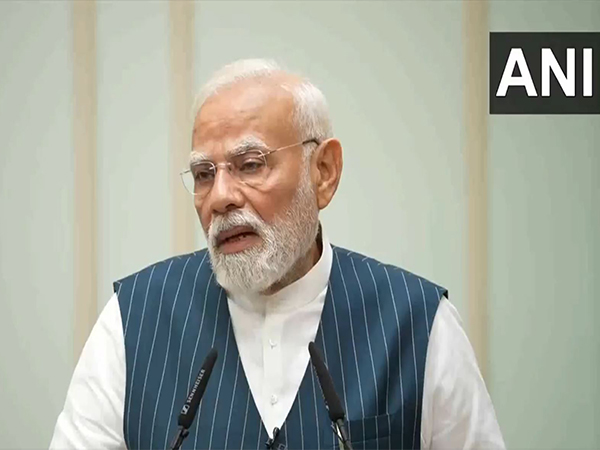

Gandhinagar (Gujarat) [India], September 4 : Gujarat Minister Rushikesh Patel on Thursday applauded the newly introduced Goods and Services Tax (GST) reforms announced in the country, stating that no sector had remained untouched and people in all industries would benefit vastly.

He further called the reforms a "big gift" to the people of the country, especially the middle class and poor families.

"PM Modi had made a promise that the Diwali this year will be really good for the people of India, that he is going to present a big gift. Now, GST Council has made a really good decision and for middle-class families, poor families. He first gave a big gift with the tax exemption up to Rs 12 Lakh income. But now, with GST reform for our entire economic ecosystem - no sector has remained untouched...This will vastly benefit people in all sectors..." Patel told ANI.

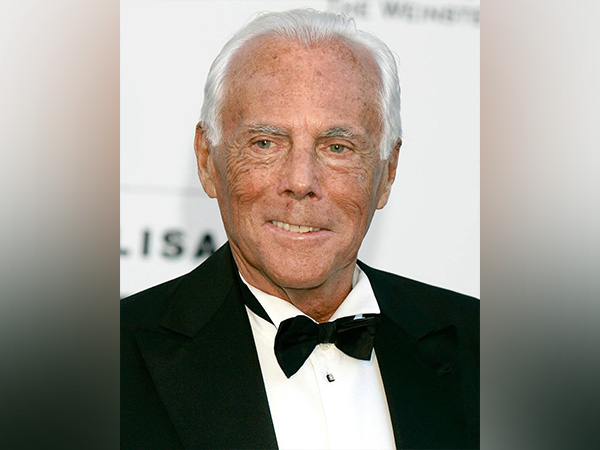

Meanwhile, AIMIM Chief and Hyderabad MP Asaduddin Owaisi criticised the Centre's claim that the latest reforms in GST would boost consumption and stated that the rhetoric and dialogue have not helped the common man in the past decade.

The AIMIM leader warned that state governments could collectively face a revenue shortfall of Rs 8,000-10,000 crore each as a result of the changes.

Speaking to the media, he said, "All the rhetoric and dialogue that we have seen in the last 11 years have not helped the common man. We can't welcome it because it will have a very bad impact on the revenue and finances of the states and every state will face a revenue loss 8 to 10 thousand crores."

The 56th GST council approved on September 3 to rationalise GST rates to two slabs of 5 per cent and 18 per cent by merging the 12 per cent and 28 per cent rates.5% slab consists of essential goods and services, including food and kitchen item like butter, ghee, cheese, dairy spreads, pre-packaged foods, agricultural equipment, handicrafts, medical equipment and multiple other things.

The 18% slab consists of a standard rate for most goods and services, including automobiles such as small cars and motorcycles (up to 350cc), consumer goods like electronic items, household goods, and some professional services, a uniform 18% rate applies to all auto parts.

Additionally, there is also a 40% slab for luxury and sin goods, including tobacco and pan Masala, products like cigarettes, bidis, and aerated sugary beverages and on luxury vehicles, high-end motorcycles above 350cc, yachts, and helicopters.

Additionally, GST is not applicable to health and life insurance premiums, as well as education and healthcare services, such as certain services related to education and healthcare, which are also GST-exempt.