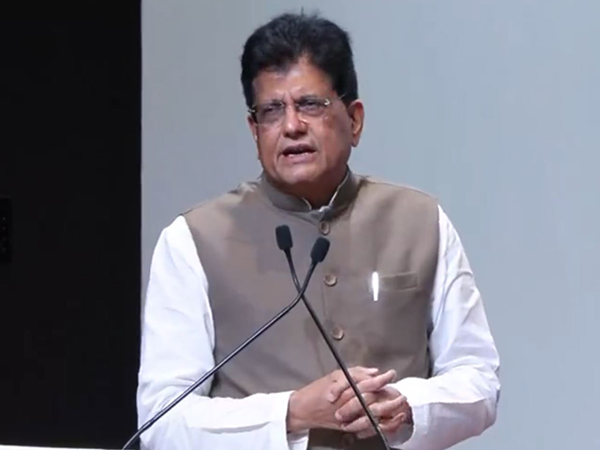

"Step in the direction of ensuring an Atmanirbhar Bharat": Piyush Goyal lauds GST reforms

Sep 04, 2025

New Delhi [India], September 4 : Lauding the recent GST reforms, Union Minister of Commerce and Industry Piyush Goyal termed it as a significant step in the direction of ensuring an 'Atmanirbhar Bharat'.

Goyal emphasised that the collective resolve of 140 crore Indians will drive the country towards becoming a 'Viksit Bharat' by 2047.

Speaking at the IPHEX 2025 International Exhibition on Pharma and Healthcare, the Union Minister said, "Yesterday's GST reforms are a step in the direction of ensuring an Atmanirbhar Bharat, an India which is self-sufficient, self-reliant, an India whose supply chains are self-reliant, an India that cares for every Indian. 140 crore Indians coming together with the collective resolve to make India, Viksit Bharat by 2047, a developed and prosperous nation where everybody gets opportunity, where everybody becomes a participant of India's inclusive and sustainable growth story."

He further expressed confidence in India's ability to weather challenges and uncertainties in the future, stating, "Our country is seeing a sea change in terms of our confidence to take on bigger and greater challenges in the future, India stands strong, India stands united. India has the confidence to weather many situations. We have done that in the past."

As India's economy surged ahead with a robust 7.8 per cent growth in the first quarter of FY 2025-26, the Union Minister lauded the collective resolve and commitment of 1.4 billion Indians.

He said, "By 2047, we will grow from a $4 trillion economy to a $30 trillion economy. We all have our duties defined for us. It is the collective resolve and commitment of 1.4 billion Indians that powers this country, that makes us the world's fastest growing economy, that ensures even in Q1, in a highly volatile, uncertain, buka climate, geopolitical risks, India grows at 7.8% and that is only possible when you have a decisive leader like Narendra Modi guiding and leading the country..."

"The world knows that India offers them fair and equal treatment. There is a rule of law, there are courts, there is a vibrant media, there is a parliament. India provides the world comfort and confidence as a vibrant democracy with a demographic dividend of a young population, the demand that 1.4 billion Indians generate for goods and services, and the decisive leadership that PM Narendra Modi provides. It is this collective bouquet of offerings that defines India," Union Minister Goyal stated.

Speaking about the opposition questioning GST Reforms, the Union Minister said that this reflected the negative thining of a certain set of people.

"Sadly, just like Rahul Gandhi does not understand that the world's fastest growing large economy at 7.8% growth in the first quarter is a matter of delight, joy and celebration and calls India, a dead economy despite being the world's fastest growing large economy, this is the negative thinking of a certain set of people and I condemn this kind of negativity... It is because of the negative thinking of the opposition that they are in this condition today and the people of the country are standing with PM Modi," he said.

The 56th GST council meeting decided to rationalise GST rates to two slabs of 5 per cent and 18 per cent by merging the 12 per cent and 28 per cent rates, which will come into effect from September 22, 2025.

5% slab consists of essential goods and services, including food and kitchen item like butter, ghee, cheese, dairy spreads, pre-packaged namkeens, bhujia, mixtures, and utensils; agricultural equipment like drip irrigation systems, sprinklers, bio-pesticides, micronutrients, soil preparation machines, harvesting tools, tractors, and tractor tires; handicrafts and small industries like sewing machines and their parts and health and wellness like medical equipment and diagnostic kits.

While the 18% slab consists of a standard rate for most goods and services, including automobiles such as small cars and motorcycles (up to 350cc), consumer goods like electronic items, household goods, and some professional services, a uniform 18% rate applies to all auto parts.

Additionally, there is also a 40% slab for luxury and sin goods, including tobacco and pan Masala, products like cigarettes, bidis, and aerated sugary beverages and on luxury vehicles, high-end motorcycles above 350cc, yachts, and helicopters.

Moreover, some essential services and educational items are fully exempted from GST, including individual health, family floater and life insurance, no GST on health and life insurance premiums and education and healthcare, like certain services related to education and healthcare are GST-exempt.