"Will reduce burden on common consumers": Rajasthan CM Bhajanlal Sharma calls GST reforms "historic"

Sep 04, 2025

Jaipur (Rajasthan) [India], September 4 : Terming GST reforms "historic", Rajasthan Chief Minister Bhajanlal Sharma on Thursday said the move to rationalise slabs covering maximum items will help reduce the tax burden on the common consumers.

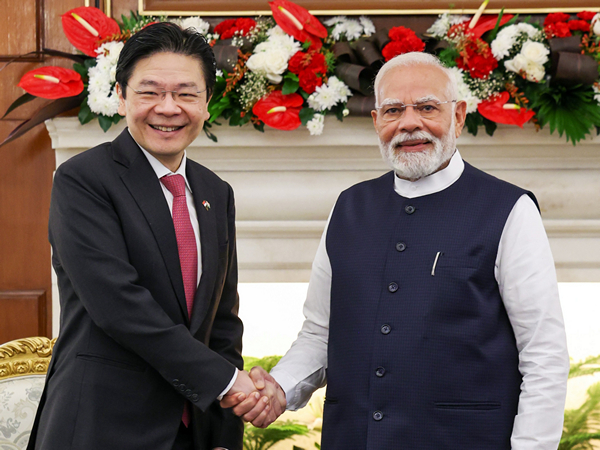

In a post on X, Rajasthan CM also hailed Prime Minister Narendra Modi's leadership over the sweeping reforms that have been announced.

"In line with the announcement of next-generation reforms in GST in the Prime Minister Shri @narendramodi ji's Independence Day speech, the decision to abolish the 12% and 28% GST slabs in the GST Council meeting held under his guidance is historic," CM wrote on X.

He asserted that the decision will not only make the tax system more straightforward but also transparent.

"This unprecedented decision will not only make the tax system even simpler and more transparent, but will also provide significant relief to the common people, farmers, MSME industries, middle-class families, women, and youth. This will reduce the tax burden on common consumers, provide encouragement to small industries, and give a new direction to investment and trade," Bhajanlal Sharma said.

Finance Minister Nirmala Sitharaman on Wednesday announced a sweeping reduction in GST, aimed at providing relief to households, farmers, businesses and the healthcare sector.

Meanwhile, Rajasthan Minister Jogaram Patel expressed gratitude to Prime Minister Narendra Modi and Union Finance Minister Nirmala Sitharaman over the GST reforms, stating that the decision is a gift for the common people.

"The Prime Minister had said on Independence Day that this time Diwali will come very well. In the GST Council meeting under FM Nirmala Sitharaman, changes to the GST slabs have been made as a gift to the people," Patel told ANI.

The 56th GST council meeting decided to rationalise GST rates to two slabs of 5 per cent and 18 per cent by merging the 12 per cent and 28 per cent rates.

5% slab consists of essential goods and services, including food and kitchen item like butter, ghee, cheese, dairy spreads, pre-packaged namkeens, bhujia, mixtures, and utensils; agricultural equipment like drip irrigation systems, sprinklers, bio-pesticides, micronutrients, soil preparation machines, harvesting tools, tractors, and tractor tires; handicrafts and small industries like sewing machines and their parts and health and wellness like medical equipment and diagnostic kits.

While the 18% slab consists of a standard rate for most goods and services, including automobiles such as small cars and motorcycles (up to 350cc), consumer goods like electronic items, household goods, and some professional services, a uniform 18% rate applies to all auto parts.

Additionally, there is also a 40% slab for luxury and sin goods, including tobacco and pan Masala, products like cigarettes, bidis, and aerated sugary beverages and on luxury vehicles, high-end motorcycles above 350cc, yachts, and helicopters.

Moreover, some essential services and educational items are fully exempted from GST, including individual health, family floater and life insurance, no GST on health and life insurance premiums and education and healthcare, like certain services related to education and healthcare are GST-exempt.