Next-gen GST reforms: Health, life insurance made tax-free, several medical essentials made cheaper

Sep 03, 2025

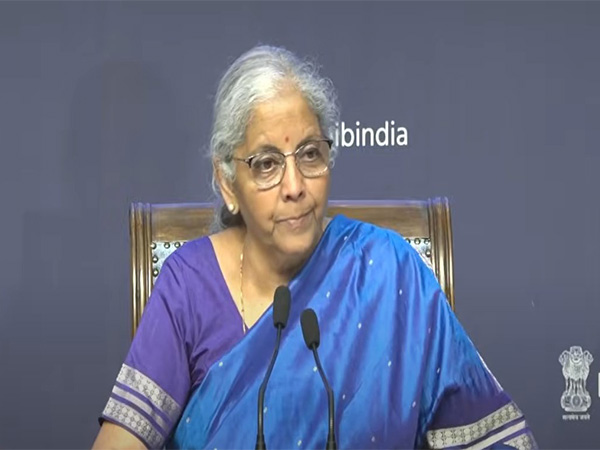

New Delhi [India], September 4 : The landmark next-generation GST reforms that were announced on Wednesday include significant relief to citizens in the healthcare and insurance sectors.

One of the biggest announcements is the complete removal of GST on individual health and life insurance.

Until now, they have attracted 18 per cent GST.

With the new reform, they have been moved to the zero-tax bracket, making health and life insurance more affordable and accessible to a wider section of society.

These reforms, cleared by the GST Council, are expected to reduce the cost of essential medical items and health-related financial services.

In addition to this, GST rates on several critical medical items have been reduced from 12 per cent to just 5 per cent. They include a thermometer, medical-grade oxygen, all diagnostic kits and reagents, glucometers and test strips, as well as corrective spectacles.

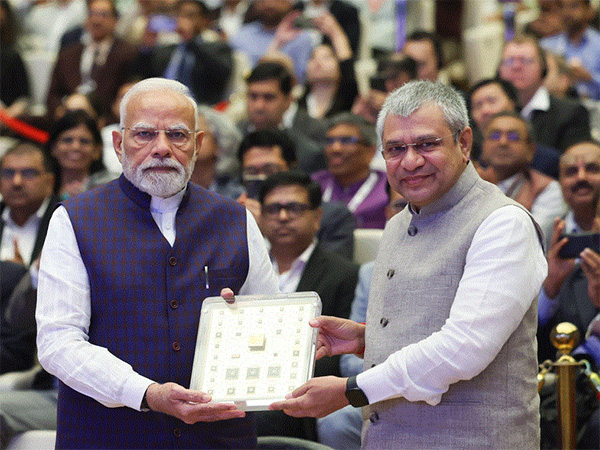

Meanwhile, Prime Minister Narendra Modi hailed the reforms, stressing that they will benefit the common man, farmers, MSMEs, the middle class, women, and youth.

"During my Independence Day Speech, I had spoken about our intention to bring the Next-Generation reforms in GST. The Union Government had prepared a detailed proposal for broad-based GST rate rationalisation and process reforms, aimed at ease of living for the common man and strengthening the economy. Glad to state that @GST_Council, comprising the Union and the States, has collectively agreed to the proposals submitted by the Union Government on GST rate cuts & reforms, which will benefit the common man, farmers, MSMEs, middle-class, women and youth. The wide-ranging reforms will improve the lives of our citizens and ensure ease of doing business for all, especially small traders and businesses," PM Modi posted on X.

On the essential items front, items of daily household use will now cost less. Products such as hair oil, shampoo, toothpaste, toilet soap bars, toothbrushes, and shaving cream, which earlier attracted 18 per cent GST, will now fall under the 5 per cent bracket.

Similarly, butter, ghee, cheese, dairy spreads, pre-packaged namkeens, bhujiya, and mixtures have all seen their GST rate reduced from 12 per cent to 5 per cent.

Utensils, feeding bottles, baby napkins, and clinical diapers have also become cheaper with the rate cut to 5 per cent.